Experienced professional property investors should not be too worried about the recent section 24 landlord tax changes although of course they need to be understood and considered. If an investment or particular deal can’t handle a stress test then like other deals, such as bank loans, commercial loans, mortgages, it’s not going to be a great deal in the first place.

Investors will always find new ways to do business in the new and ever changing climate of the United Kingdom, rules and regulations always change, they need to change, nothing especially in the property market sits still. Landlord Tax is one of them. The pivot of all economy, sometimes it accelerates the markets, sometimes it steps in to cool it down.

Property investors talk about landlord tax a lot because it really matters as it going to be the biggest expense, after your buy-to-let mortgage costs (if you have one). Understanding the way landlord tax works will help you find ways to reduce your bill and maximise the profit on your investment.

What is the latest story on landlord tax? Well to begin with when you start letting property, you must tell the government – HM Revenue and Customs (HMRC) as you may have to pay Income Tax (you may). If you don’t, it is very likely you could face a penalty and if you’re in a situation where you might owe tax from previous years, then you need to contact HMRC directly, because accepting will be in your favour as stated in the Government websites.

So basically any profit you make from renting out your property becomes a part of your income, and therefore will be subject to Income Tax.

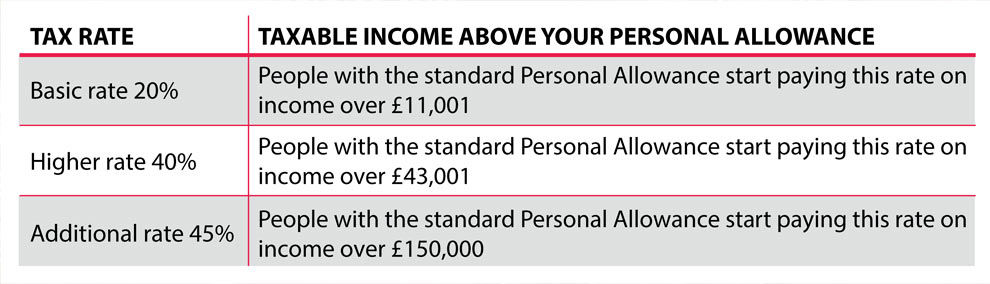

The amount of tax you pay on this is subject to your total taxable income. If you pay the basic rate of tax then you’ll pay 20%, while if you’re a higher rate taxpayer, you’ll pay 40%, and if you’re in the additional rate bracket you’ll pay 45%.

If you happen to live in Scotland, you may pay a different rate of Income Tax to the rest of the UK.

You may also be eligible, claim Income Tax reliefs, which simply means that you either pay less tax to account for monies you’ve spent on specific items or get tax repaid. Tax reliefs normally get paid automatically, but there are others you may need to apply for to be eligible.

Setting up a separate account for your rental income can be the best way forward when calculating your costs. In return this can help stop your various revenue streams from becoming confused, effectively making it easier for you to work out your profit, expenses and other forms of income.

Always deduct Allowable Expenses first and not last, as it is very important to remember that only profits from renting out your property will be liable for income tax.

Calculating ‘allowable expenses’

As you calculate your expenses, there is a difference between revenue and capital expenses.

Revenue expenses

relate to the day-to-day running and maintenance of the property and can always be offset against the income tax bill.

Capital expenses

are factors that will increase the value of the property, when works such as renovations are carried out. These can’t be deducted from your income tax bill, but you might be able to offset them against the Capital Gains Tax.

In a nutshell all costs that are deemed to be required and essential in performing your duties as a landlord can be offset against your rental income, this will significantly reduce your tax liability.

Allowable expenses

are things you need to spend money on as part of the day to day running of the property, including:

- Agent’s letting agents’ fees

- Legal fees for a year or less, or for the renewing a lease for less than 50 years

- Accountants’ fees

- Buildings and contents insurance

- Interest on any property loans you have taken out

- Expenses spent on maintenance and repairs excludes home improvements)

- Utility bills, gas, electricity and water

- Rent, ground rent and service charges

- Council tax bills

- Services such as cleaning and gardening

- Direct costs such as phone calls, advertising or stationery

Things that you can’t claim as allowable expenses include:

Mortgage payment

Only the interest element of your mortgage payment can be offset against your income

Private telephone calls

Only claim for the cost of calls relating to letting property

Personal expenses

Costs incurred solely for your rental business

If you’re a landlord who’s letting a furnished property, then you can claim 10% of the net rent as which would be known as a ‘wear and tear allowance’. This can be used on any furnishings that you will be providing to your tenants.

This is based on the net rent you receive, less any costs that your tenant would usually pay – such as council tax.

However, in the 2015 Summer Budget, the Chancellor of the Exchequer announced that landlords can no longer deduct 10% of the rent charged for ‘acceptable wear and tear’, even if no actual improvements had been made. And as of April 2016, landlords have only been able to deduct expenses they actually incur.

What are the New Stamp Duty Rises? The other tax

As of 1st April 2016, anyone who purchased an additional property will be liable to an increased rate of stamp duty of 3%. That’s the cooling part of tax. Obviously the changes were an attempt by the Government to curb and slow down the buy-to-let property market which was the main reason why growth has happened massively, making it a lot harder for first time buyers to get on the property ladder. These tax duty rises where then followed by reductions in mortgage interest relief in April 2017, something that has hit landlords.

The new rates will apply to all properties, including holiday homes, off-plan purchases and buildings in the process of being converted into a dwelling.

Commercial properties, however, are expect which is why a lot of investors have turned their eyes onto this market, but there is isn’t as much stock out there as there was 3-5 years ago. The New Stamp Duty Tax Rates Stamp duty currently falls into bands based on the value of your existing residential property.

Properties up to £125k of this is at a zero rate, but increases to 2% on property values between £125k – £250k. Buying a second property this initial zero rate band would then be set at 3%, with anything between £125k – £250k incurring 5% in stamp duty. Below is a table for both existing residential rates and additional properties.

One final part of that needs to be mentioned is that landlords will no longer be able to deduct all of their costs to arrive at their property profits. Instead, they will receive a basic rate reduction from their Income Tax liability. The scheme will be introduced gradually, meaning that:

- In 2017-2018, the deduction from property income (as is currently allowed) will be restricted to 75% of finance costs. The remaining 25% is available as basic rate tax reduction

- in 2018-2019, this will change to 50% finance costs deduction and 50% given as a basic tax reduction

- in 2019-2020, this will change again to 25% finance costs deduction and 75% given as a basic rate tax deduction

- from 2020-2021, all financing costs incurred by a landlord will be given as a basic rate tax deduction

Capital Gains Tax was the tax all landlords and investors knew was in the horizon, nowadays it’s going to bite a little bit more and more.

Landlords are required to pay Capital Gains Tax (CGT) when they sell a property that’s increased in value. Unless it’s their main residence. This calculation is pretty straight-forward, deduct the price you bought the property for from the total you’re selling it for including the costs such as agents’ or solicitors’ fees and the costs of improvement works.

You can find out how much CGT you may need to pay by using a calculator like this. Government guidance on the complex terms and conditions of CGT, which you can find here.

Finally, the best part for some landlords, If you’re making a loss on your rental properties then you will have to deduct any losses from profits by entering the figure on your Self-Assessment form, and don’t’ forget that your losses can be offset against future profits (by carrying it over to a later year) or against profits from other properties in your property portfolio.