Last Updated: September 2025 | Reading Time: 9 minutes

Table of Contents

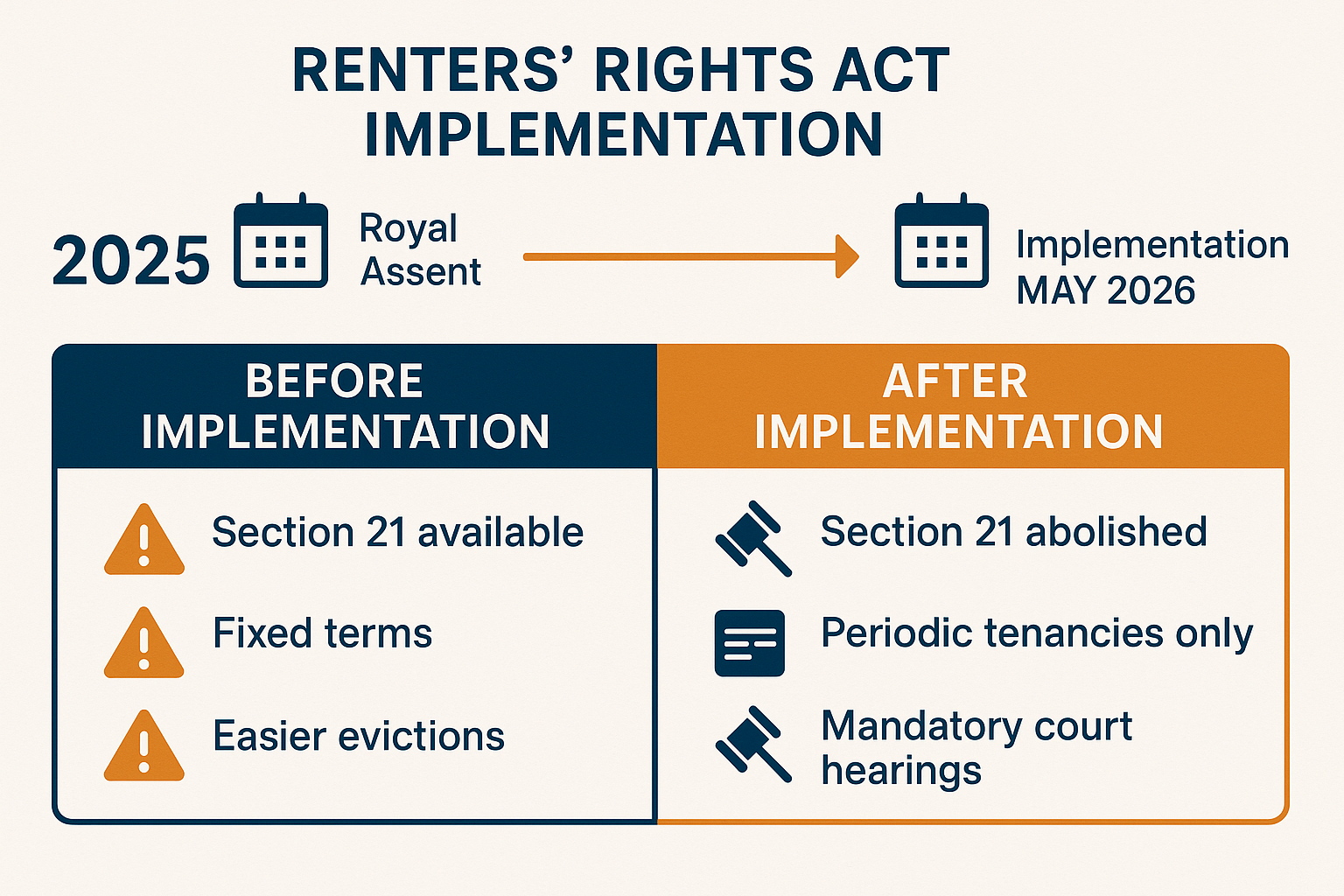

Breaking: The Renters Rights Act received Royal Assent in September 2025. By early 2026, the UK rental market will be fundamentally and permanently changed.

For landlords, the new legislation brings a wave of uncertainty. The abolition of Section 21 “no-fault” evictions, the end of fixed-term tenancies, and a raft of new compliance burdens are creating a perfect storm of risk and complexity. With court eviction timelines already stretching to an average of 33.8 weeks [1], many landlords are understandably concerned about the future of their investments.

This article will provide a comprehensive overview of the Renters Rights Act, its impact on landlords, and why a growing number of property owners are turning to guaranteed rent schemes as a secure and profitable alternative.

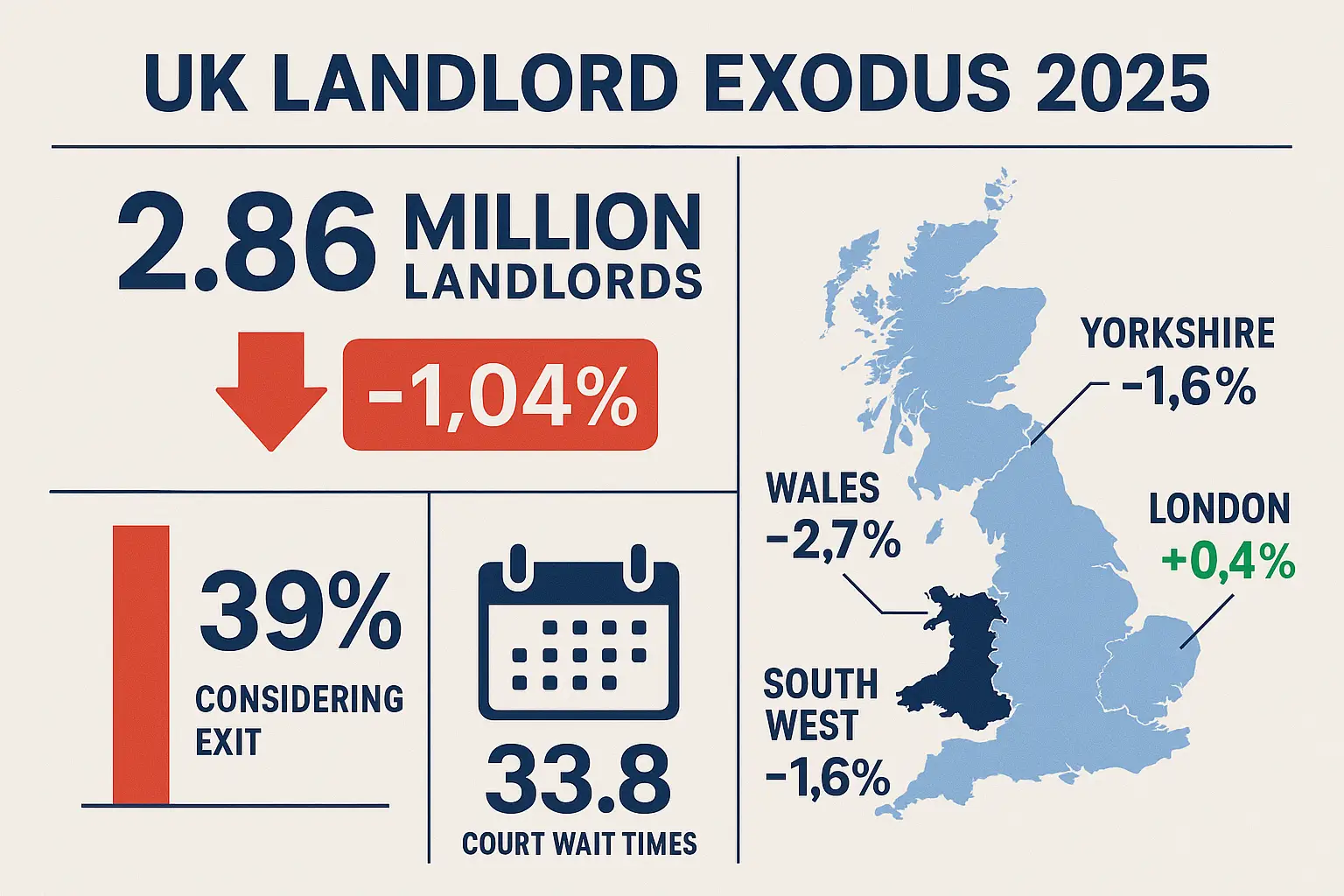

The Landlord Exodus: A Market in Flux

The numbers paint a stark picture of the current rental market. According to the latest government data from August 2025, the number of landlords in England has fallen to 2.86 million, a 1.04% decrease in just one year [2]. This exodus is being driven by individual landlords, with some regions like Wales seeing a 2.7% drop in landlord numbers.

A recent survey by Property Industry Eye found that 39% of landlords are considering leaving the market entirely in the next year [3]. This sentiment is echoed by letting agents, 70% of whom report that landlords are already selling their properties. The primary drivers of this exodus are the increasing regulatory burden, rising operational costs, and the uncertainty surrounding the Renters Rights Act.

The Brutal Truth: What’s Actually Changing

The Renters Rights Act introduces several fundamental changes that will impact every landlord in the UK. Understanding these changes is the first step to adapting your strategy and protecting your investment.

1. The End of Section 21 Evictions

The most significant change is the complete abolition of Section 21 “no-fault” evictions. This means that landlords will no longer be able to regain possession of their property without providing a valid legal reason. All evictions will now fall under Section 8, requiring landlords to prove their case in court. This will inevitably lead to longer and more costly eviction processes. Our detailed guide on how to evict a tenant in the UK provides more information on this complex process.

2. The Death of Fixed-Term Tenancies

All new and existing tenancies will automatically convert to periodic, or rolling monthly, contracts. This gives tenants the flexibility to leave with just two months’ notice at any time. For landlords, this creates significant income uncertainty, making it difficult to plan for void periods and secure consistent cash flow.

3. Rent Increases Under Scrutiny

Landlords will be limited to one rent increase per year, which must be served with a formal Section 13 notice. If a tenant disagrees with the increase, they can challenge it at a tribunal, a process that can take months to resolve. This makes it harder for landlords to keep up with rising mortgage rates and other landlord costs.

4. A New Wave of Compliance

The Act introduces a raft of new compliance requirements, including:

- Private Rented Sector Database: Mandatory registration for all landlords.

- Landlord Ombudsman: Mandatory membership to resolve disputes.

- Decent Homes Standard: A new minimum standard for all rental properties.

- Awaab’s Law: Strict timeframes for fixing hazards.

Failure to comply with these new rules can result in fines of up to £40,000 and will prevent you from legally evicting a tenant.

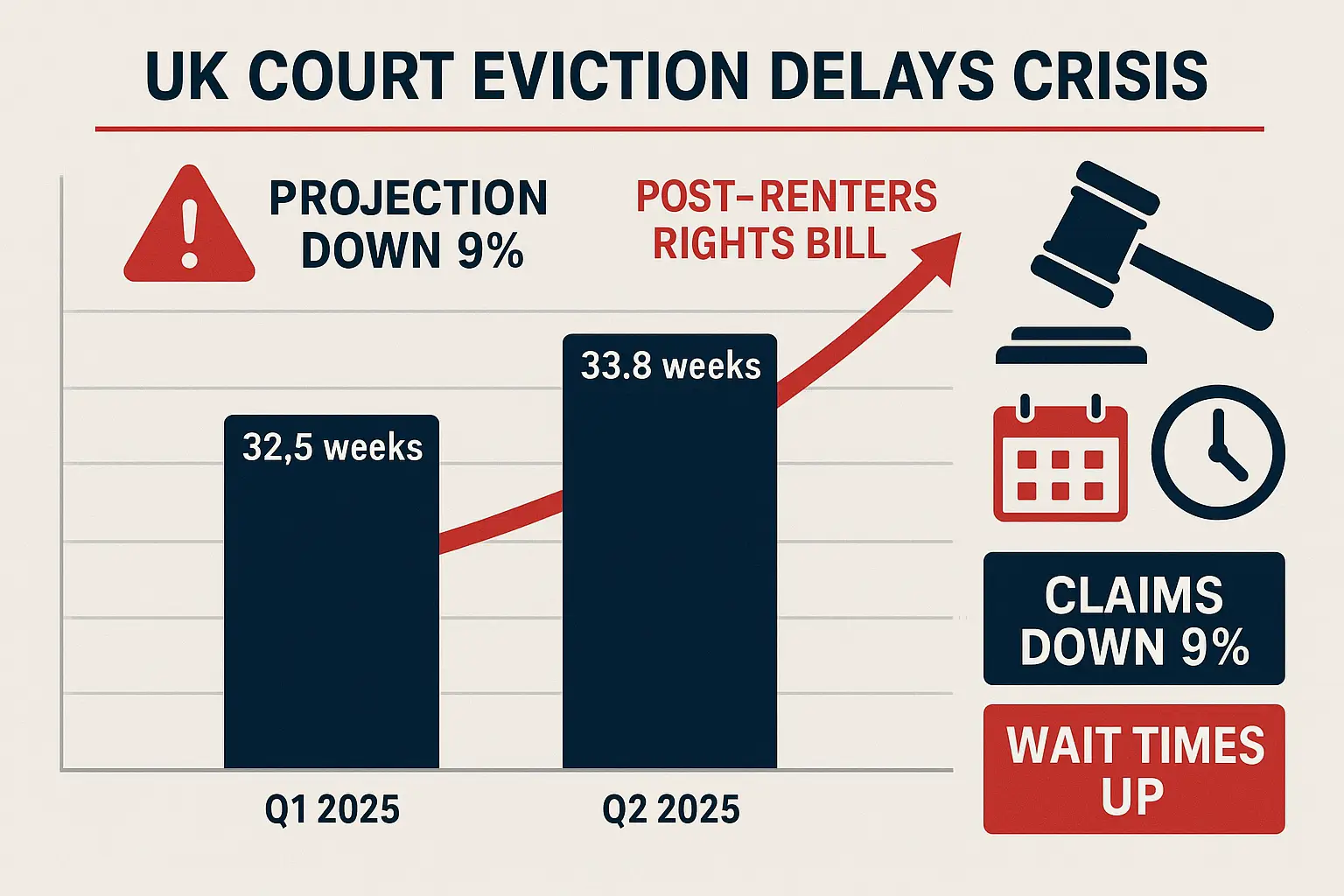

The Court System Crisis

The UK’s court system is already struggling to cope with the current volume of possession cases. The average wait time for an eviction is now 33.8 weeks, and this is expected to increase significantly after the abolition of Section 21 [1].

With all evictions requiring a court hearing, the already overburdened system is likely to face an “avalanche” of new cases, as described by NRLA Chief Executive Ben Beadle [4]. This will lead to even longer delays, increased legal costs, and more lost rental income for landlords.

How Guaranteed Rent Sidesteps the Chaos

For landlords looking for a way to navigate this new and challenging landscape, guaranteed rent offers a powerful solution. By entering into a company let agreement with a provider like AMS Housing Group, you can effectively sidestep the complexities and risks of the Renters Rights Act.

The Power of a Company Let

A company let is a commercial lease agreement between you and a business entity. This means that the Housing Act 1988 and the Renters Rights Act do not apply in the same way. Your only tenant is the company, which then sublets the property and manages all tenant-related issues.

This arrangement provides a number of key benefits:

- Guaranteed Income: You receive a fixed monthly rent, regardless of void periods or tenant arrears.

- No Eviction Hassles: The provider is responsible for all tenant management, including any necessary evictions.

- Compliance Handled: The provider manages all compliance requirements, including the new rules under the Renters Rights Act.

- Reduced Admin: You no longer have to deal with tenant queries, maintenance issues, or rent collection.

The Financial Advantage

While guaranteed rent schemes typically offer a slightly lower headline rent (around 80-85% of the market rate), the financial benefits often outweigh this difference. When you factor in the costs of void periods, potential eviction costs, and the time and stress of managing a property under the new rules, guaranteed rent can be a more profitable option. Our guaranteed rent calculator can help you compare the potential returns.

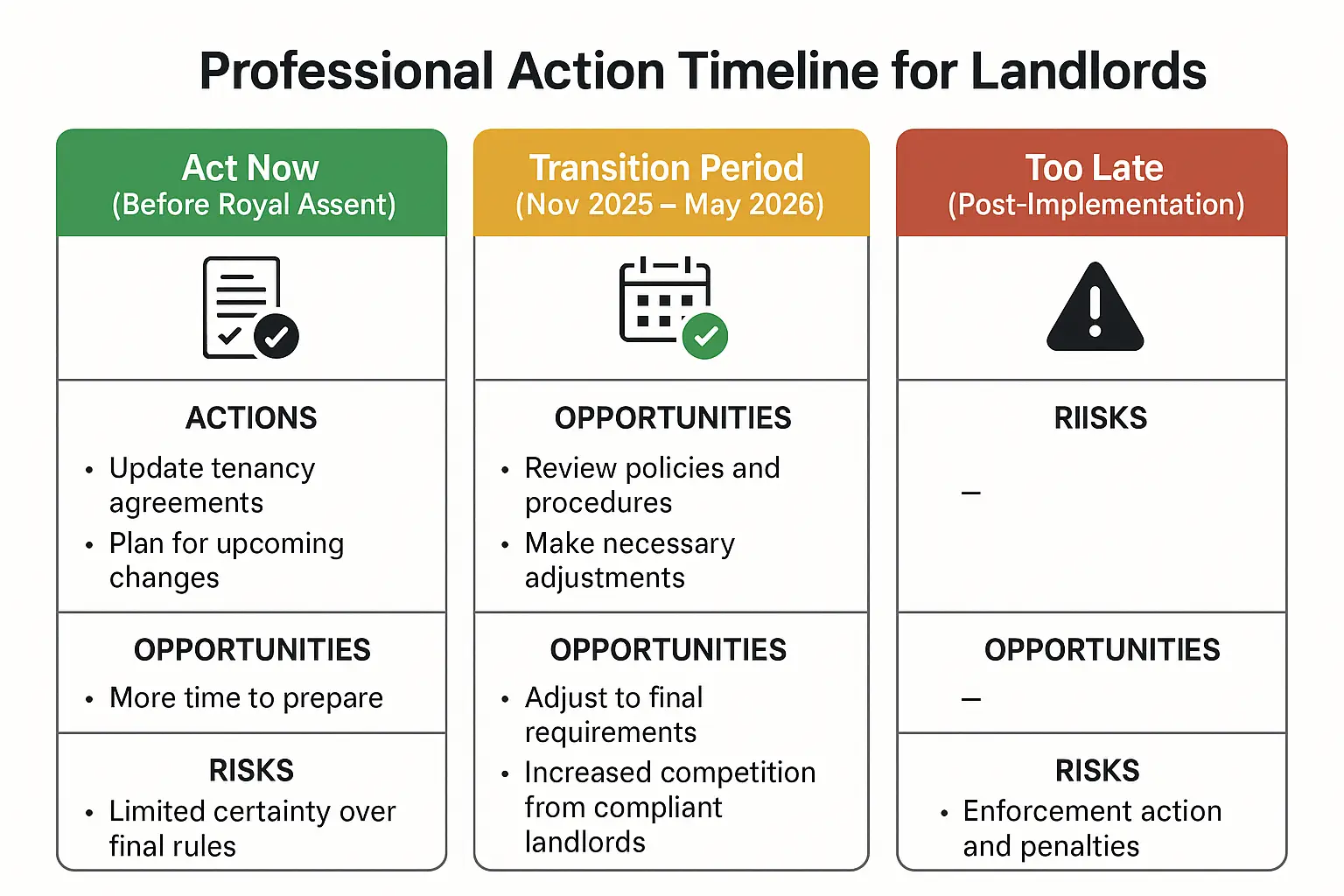

The Smart Landlord’s Action Timeline

The time to act is now. With the Renters Rights Act set to be implemented in early 2026, smart landlords are already adapting their strategies to protect their investments.

Now (Before Full Implementation)

- Lock in a guaranteed rent contract: Secure a long-term agreement at a favorable rate before providers adjust their pricing to account for the new risks.

- Review your portfolio: Identify properties that are most vulnerable to the new rules and consider your options.

- Get a free portfolio review: Contact AMS Housing Group for a no-obligation assessment of your properties and a guaranteed rent quote.

Transition Period (Late 2025 – Early 2026)

- Expect increased demand for guaranteed rent: As more landlords become aware of the changes, demand for guaranteed rent schemes will likely increase.

- Providers may become more selective: As the risks increase, providers may become more selective about the properties they take on.

Post-Implementation (Early 2026 onwards)

- The new reality begins: All tenancies will be periodic, and all evictions will require court action.

- Too late for the best deals: It will be much harder to secure a favorable guaranteed rent agreement once the new rules are in full effect.

Is Guaranteed Rent Right for You?

Guaranteed rent is an ideal solution for many landlords, particularly:

- Overseas Landlords: Manage your UK properties from anywhere in the world without worrying about compliance or tenant issues.

- Accidental Landlords: If you’ve inherited a property or relocated for work, guaranteed rent offers a hands-off way to generate income.

- Portfolio Landlords: Simplify the management of multiple properties and reduce your administrative burden.

- “I’m Done” Landlords: If you’re considering selling up, guaranteed rent can provide a stable income while you decide on your next move.

Why Choose AMS Housing Group?

At AMS Housing Group, we have been providing guaranteed rent services for over a decade. We have a proven track record of success, and our experienced team is ready to help you navigate the new rental landscape.

We offer:

- Transparent and fair contracts

- Sustainable and competitive rates

- Full client money protection

- A fast and efficient service

We understand the challenges that landlords are facing, and we are committed to providing a service that is reliable, professional, and profitable. Contact us today for a free, no-obligation guaranteed rent quote and find out how we can help you protect your investment and secure your rental income for years to come.

References

[1] NRLA. (2025, August 21). Renters’ Rights warning as court backlogs continue to build. Retrieved from https://www.nrla.org.uk/news/court-wait-times-up-despite-number-of-claims-falling

[2] Landlord Today. (2025, September 25). New figures show latest exodus of individual landlords. Retrieved from https://www.landlordtoday.co.uk/breaking-news/2025/09/new-figures-show-latest-exodus-of-individual-landlords

[3] Property Industry Eye. (2025, September 21). BTL landlords prepare to exit market in droves amid renters’ rights shake-up. Retrieved from https://propertyindustryeye.com/btl-landlords-prepare-to-exit-market-in-droves-amid-renters-rights-shake-up/

[4] NRLA. (2025, August 21). Renters’ Rights warning as court backlogs continue to build. Retrieved from https://www.nrla.org.uk/news/court-wait-times-up-despite-number-of-claims-falling