Table of Contents

Introduction

Picture this: Sarah, a landlord in West London, just discovered her tenant is significantly behind on rent. While recent data shows tenant arrears have improved, the average amount still stands at £1,861 according to the latest industry reports [1]. Her deposit? Only £1,316. She’s looking at months of legal proceedings under the new Renters’ Rights Bill, and she still has her mortgage to pay.

Meanwhile, her colleague David hasn’t thought about rent collection in two years. His guaranteed rent provider at AMS Housing Group deposits £1,650 into his account like clockwork every month, rain or shine, occupied or empty.

Key Takeaways

Before diving into the details, here are the essential points every landlord needs to understand about the current rental market:

- Tenant arrears have improved but still average £1,861 in Q2 2025, with deposits typically covering only 70% of potential losses

- Section 21 “no-fault” evictions will be completely abolished in early 2026, fundamentally changing the eviction process

- Guaranteed rent typically offers 85-92% of market rate but eliminates void periods, arrears risk, and management responsibilities

- The average UK property sits empty for 21 days between tenancies, costing landlords nearly a month’s rent

- Company lets (guaranteed rent) sidestep many Housing Act requirements, offering legal simplicity in an increasingly complex landscape

What You’ll Learn:

- Why the rental market has fundamentally changed and what it means for landlords

- How guaranteed rent actually works and what AMS Housing Group provides

- The real mathematics behind both options using curren data

- Which option suits your specific situation

- How to make the switch without complications

The Rental Market Has Changed — Have You?

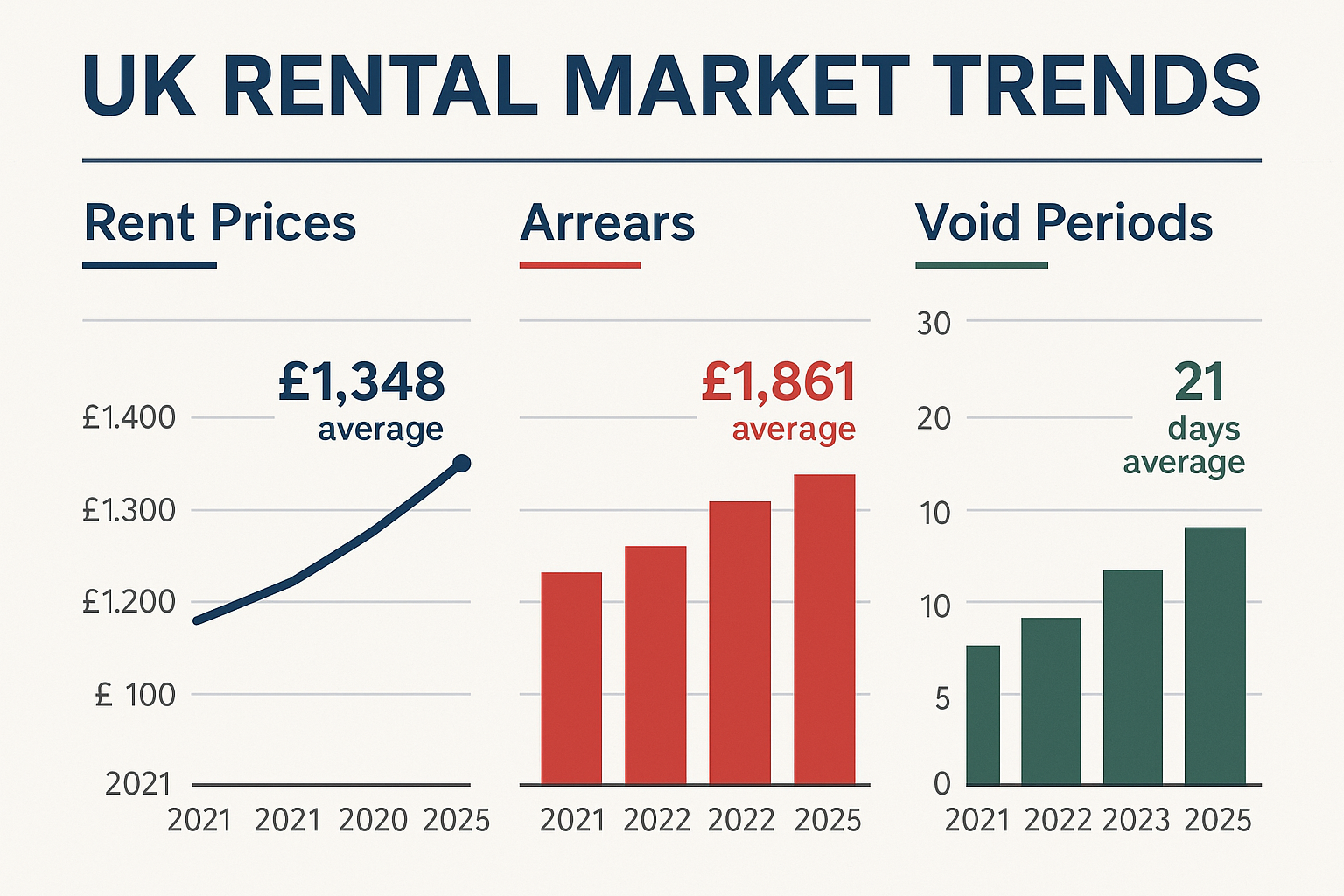

The UK rental market bears little resemblance to the landscape of even five years ago. According to the Office for National Statistics, average UK monthly private rents reached £1,348 in August 2025, representing a 5.7% increase year-on-year [2]. However, the story behind these numbers reveals a market in transition.

Reality Check

While tenant arrears have shown improvement, dropping 20% in Q2 2025 to an average of £1,861, this still represents a significant financial exposure for landlords [1]. When combined with the average deposit of £1,316, landlords face a potential shortfall of £545 per problematic tenancy before considering legal costs and void periods.

The void period challenge remains substantial. Properties across the UK average 21 days empty between tenancies, with some regions like the West Midlands experiencing 25-day averages. This translates to nearly a month’s lost rental income, averaging £957 nationally.

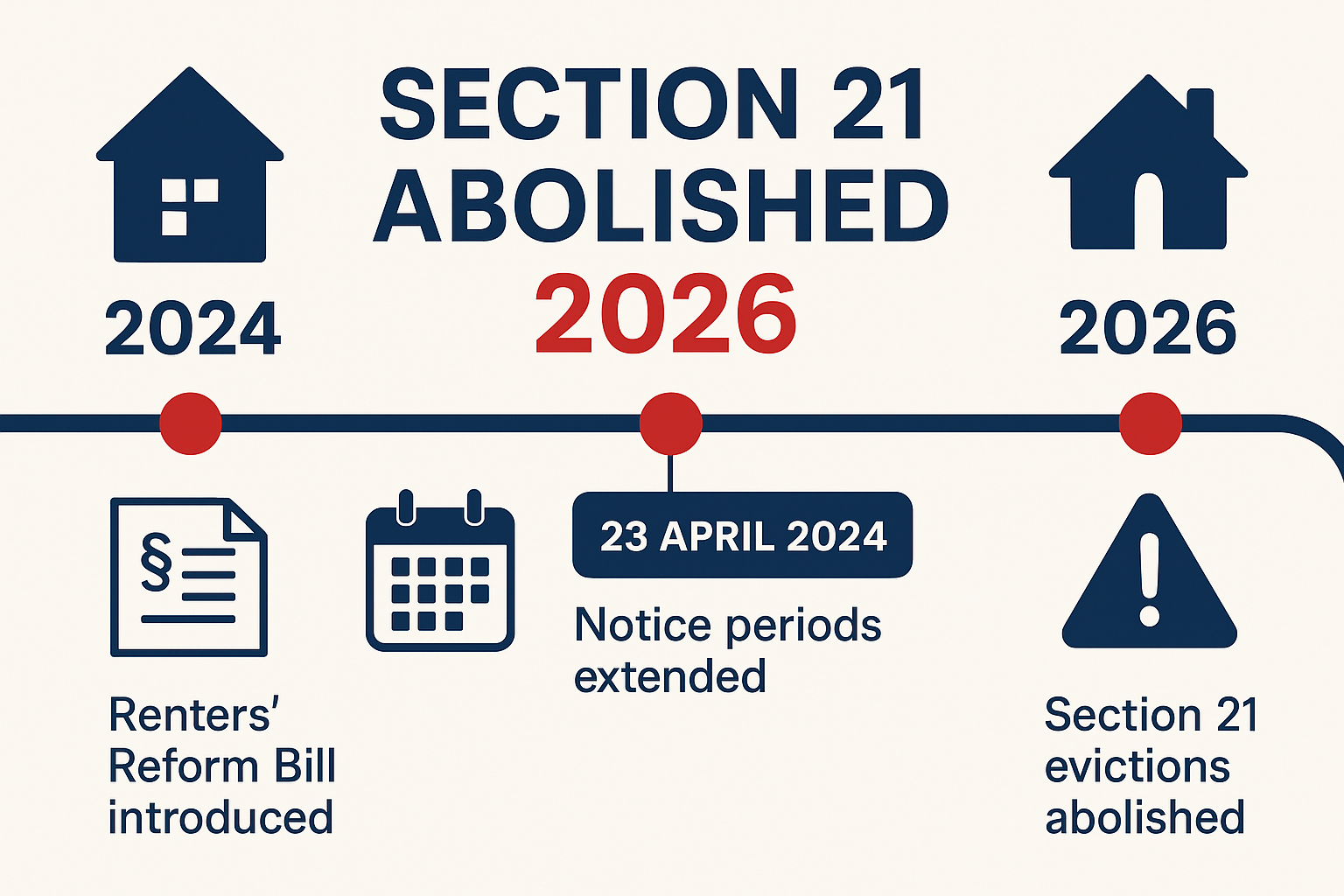

But the most significant change is legislative. Section 21 “no-fault” evictions are being completely abolished under the Renters’ Rights Bill, expected to come into force in early 2026. This means landlords will no longer be able to regain possession of their property with two months’ notice without providing a specific reason.

The Renters’ Rights Bill will deliver our manifesto commitment to transform the experience of private renting, including by ending Section 21 ‘no fault’ evictions. The bill will improve the current system for both the 11 million private renters and 2.3 million landlords in England.

– Guide to the Renters’ Rights Bill, GOV.UK [3]

Under the new system, all evictions will require court proceedings using Section 8 grounds, with extended notice periods and higher thresholds for rent arrears (three months instead of two). This makes understanding your landlord responsibilities more critical than ever.

What Guaranteed Rent Really Means (No Marketing Spin)

Guaranteed rent represents a fundamental shift in how landlords can approach property investment. Rather than dealing with individual tenants, you lease your property to a company like AMS Housing Group for a fixed term, typically 3-5 years. We become your tenant — the only tenant you’ll ever deal with.

The AMS Housing Group Approach

At AMS Housing Group, we’ve been providing guaranteed rent services across London and Essex since our establishment. Our model is straightforward: we pay you a set amount every month, whether the property is occupied, empty, or somewhere in between. We handle everything else, from finding and managing tenants to dealing with maintenance issues.

You receive:

- Fixed monthly payment (typically 85-92% of market rent)

- Zero void periods guaranteed

- Complete elimination of arrears risk

- Professional tenant management

- 24/7 maintenance support

- Legal compliance management

You retain:

- Full property ownership

- Building insurance responsibilities

- Major structural repair obligations

- Capital appreciation benefits

You transfer to us:

- Day-to-day management responsibilities

- Tenant selection and vetting

- Rent collection and arrears management

- Routine maintenance coordination

- Legal compliance for tenancies

Think of it as the difference between being a freelancer and having a salaried position. One offers higher potential earnings with significant risk and responsibility, while the other provides predictability and peace of mind at a slightly lower rate.

Traditional Letting: The Devil You Know

Traditional letting through an Assured Shorthold Tenancy (AST) remains the most common approach for UK landlords. You find tenants, they sign a contract, and they (hopefully) pay rent on time while maintaining the property appropriately.

Reality for Traditional Landlords

The landscape for traditional letting has become increasingly challenging. Beyond the financial risks of arrears and voids, landlords face an expanding web of legal requirements and compliance obligations. Understanding your landlord responsibilities has never been more important.

Self-management typically involves:

- 5-10 hours per month of active management time

- Responsibility for emergency maintenance calls

- Keeping current with evolving landlord certificates requirements

- Managing tenant relationships and disputes

- Handling rent collection and arrears procedures

Using a letting agent provides:

- Professional tenant finding and vetting

- Rent collection services

- Maintenance coordination

- Legal compliance support

- But you still bear the financial risk of voids and arrears

Management fees typically range from 10-14% plus VAT, but these don’t eliminate the core risks of traditional letting. Our property management services can help, but many landlords are discovering that guaranteed rent offers a more comprehensive solution.

The Numbers That Actually Matter

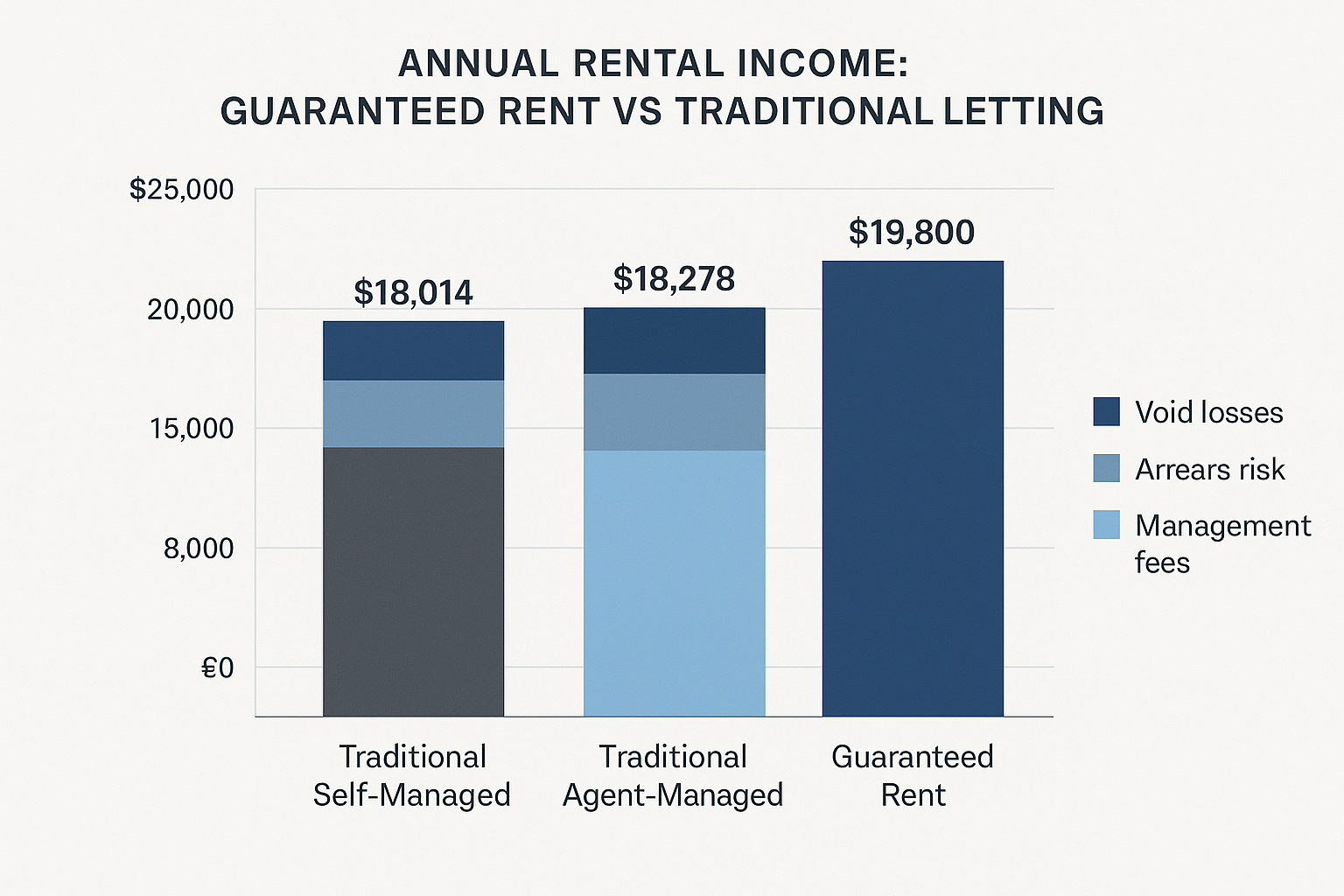

Let’s examine a real-world scenario using current market data to understand the true financial implications of each approach.

Scenario: 2-Bedroom Flat in Zone 3 London

Market rent: £1,900/month

AMS guaranteed rent offer: £1,650/month (87% of market rate)

| Approach | Annual Income | Void Loss | Arrears Risk | Management Cost | Net Income |

|---|---|---|---|---|---|

| Traditional (Self-Managed) | £22,800 | -£1,330 | -£456 | -£3,000* | £18,014 |

| Traditional (Agent-Managed) | £22,800 | -£1,330 | -£456 | -£2,736 | £18,278 |

| AMS Guaranteed Rent | £19,800 | £0 | £0 | £0 | £19,800 |

*Management cost calculated at 10 hours/month valued at £25/hour

Despite the lower headline rent, guaranteed rent delivers £1,500+ more annually than self-management and £1,500+ more than agent-managed traditional letting in this scenario.

Regional Variations Matter

These calculations shift based on location and local market conditions:

- London areas with short void periods (15 days): Traditional letting may edge ahead financially

- Areas with longer void periods (25+ days): Guaranteed rent advantage increases significantly

- Student areas with seasonal voids (3+ months): Guaranteed rent becomes overwhelmingly advantageous

Calculate Your Guaranteed Rent Potential

Use our interactive calculator above to get an instant estimate of your guaranteed rent potential based on your property’s location, type, and features. For a detailed assessment, request a [free property valuation](/valuation-enquiry/).

Guaranteed Rent Calculator

Discover your potential guaranteed rental income in London and Essex

Your Guaranteed Rent Estimate

Based on current market data for your area

Guaranteed Rent Range

Competitive guaranteed rate

Annual Income Range

Guaranteed every month

Estimated Market Rent

Current market rate

Why Choose Guaranteed Rent?

Guaranteed Rent

- Fixed monthly income

- No void periods

- Zero commission fees

- Free maintenance included

- Professional management

Traditional Letting

- Potential void periods

- Risk of rent arrears

- Agency fees (10-15%)

- Maintenance costs

- Time-consuming management

Ready to Secure Your Guaranteed Rent?

Contact our property experts for a detailed consultation and official quote.

Call Now: 020 3793 2247The Legal Minefield You’re Walking Through

The Renters’ Rights Bill has created a complex legal environment for traditional landlords. Understanding these changes is crucial for making an informed decision about your letting strategy.

Traditional AST Requirements

The compliance burden for traditional landlords continues to expand. Staying current with landlord certificates and legal requirements is essential:

- Deposit protection within 30 days of receipt

- Right to Rent checks with potential fines up to £3,000

- Current “How to Rent” guide provision

- Valid Energy Performance Certificate

- Annual Gas Safety Certificate

- Five-yearly Electrical Installation Condition Report

- Section 8 grounds as the only eviction route (Section 21 abolished)

- Extended notice periods and higher arrears thresholds

The Company Let Advantage

Guaranteed rent through a company let structure sidesteps many Housing Act 1988 requirements. The company handles occupant checks, deposit arrangements, and compliance management. This legal simplification becomes increasingly valuable as regulations continue to evolve.

As one legal expert recently observed: “The Renters’ Rights Bill has made traditional letting feel like walking through a minefield blindfolded. Company lets are like having a guide.”

Who Really Wins With Each Model?

The choice between guaranteed rent and traditional letting depends heavily on your individual circumstances, risk tolerance, and investment objectives.

Guaranteed Rent Success Stories

Paul, overseas landlord in Dubai: “Living abroad, the last thing I want is a 3 AM call about a broken boiler. AMS Housing Group’s guaranteed rent means I know exactly what hits my account each month. The peace of mind is worth every penny of the discount.”

Maria, portfolio landlord with 12 properties: “Even one problem tenant can consume weeks of my time. Using guaranteed rent on my more challenging properties freed me to focus on portfolio growth and acquisition. The portfolio review service helped me optimize my entire investment strategy.”

James, accidental landlord: “I inherited a property and knew nothing about being a landlord. AMS Housing Group’s guaranteed rent saved my sanity and gave me a reliable income stream without the learning curve.”

Traditional Letting Success Stories

Sophie, hands-on investor: “My properties are in prime Central London locations with zero void issues. I know the market inside out and have excellent long-term tenants. Why would I give up 15% for problems I don’t have?”

Robert, property developer: “I renovate and flip properties regularly. I need the flexibility to sell quickly, which long-term guaranteed rent contracts don’t provide.”

Making the Switch (Without Drama)

Whether you’re considering moving from traditional letting to guaranteed rent or vice versa, proper planning ensures a smooth transition.

From Traditional to Guaranteed Rent

- Verify mortgage consent — Most BTL mortgages require written consent for company lets

- Time the transition — Align with natural tenancy end dates to avoid complications

- Compare multiple providers — Guaranteed rent offers can vary by 15-20%

- Document property condition — Comprehensive photos and videos protect both parties

- Understand repair responsibilities — Clarify who handles what level of maintenance

From Guaranteed Rent to Traditional

- Review notice periods — Typically 3-6 months for contract termination

- Prepare for void period — Budget for 1-2 months without rental income

- Update safety certificates — Ensure all landlord certificates are current

- Research current market rates — Rental values change quickly

- Consider professional management initially — Our property management services can ease the transition

Action Plan

The rental market has shifted permanently. Taking no action is itself a decision — and often an expensive one.

If You Choose Traditional Letting

- Invest in rent guarantee insurance — £200-400 annually could save thousands

- Build a financial buffer — Maintain 3-6 months of mortgage payments in reserve

- Document everything meticulously — The burden of proof increasingly falls on landlords

- Stay legally current — Keep up with landlord responsibilities and new landlord rules

- Consider selective guaranteed rent — Use it strategically for problematic properties

If You Choose Guaranteed Rent

- Secure lender consent in writing — Never proceed without explicit approval

- Compare multiple providers — AMS Housing Group offers competitive rates and terms

- Negotiate terms where possible — Many aspects of guaranteed rent contracts are flexible

- Clarify maintenance thresholds — Understand the boundary between routine and major repairs

- Set contract review reminders — Plan for renewal or termination decisions well in advance

The Bottom Line

Sarah, our West London landlord from the opening? She switched to guaranteed rent with AMS Housing Group last month. “I calculated I’d lost £4,200 last year between voids and one particularly problematic tenant. The guaranteed rent discount costs me £2,400 annually, but I’m actually £1,800 better off, and I sleep soundly at night.”

David, our guaranteed rent advocate? He’s expanding his portfolio: “While other landlords are panicking about Section 21 abolition, I’m actively buying. My properties with AMS Housing Group run themselves, giving me time to focus on growth.”

There’s no universally “right” answer for every landlord. However, transformed market — with legislative changes, evolving tenant rights, and persistent void risks — guaranteed rent offers a compelling alternative to traditional letting’s increasing complexity.

The key is making an informed decision based on your specific circumstances, risk tolerance, and investment objectives. Whether you choose traditional letting or guaranteed rent, the important thing is adapting to the new reality rather than hoping for a return to simpler times.

Next Steps with AMS Housing Group

Ready to explore your guaranteed rent options? Here’s how we can help:

Free Property Valuation — Get an accurate assessment of your property’s guaranteed rent potential

Portfolio Review — Comprehensive analysis of your entire property portfolio

Guaranteed Rent Quote — Firm offer within 24 hours with no obligation

Contact Our Experts — Speak directly with our property specialists

Quick Reference: Key Differences at a Glance

| Factor | Traditional Letting | AMS Guaranteed Rent |

|---|---|---|

| Monthly Income | Variable (subject to voids/arrears) | Fixed and guaranteed |

| Void Risk | £957 average per void period | £0 |

| Arrears Risk | £1,861 average exposure | £0 |

| Management Time | 5-10 hours/month | Near zero |

| Legal Compliance | Landlord’s responsibility | AMS handles |

| Eviction Process | Complex Section 8 only | Simple contract terms |

| Flexibility | High | Lower (3-5 year terms) |

| Income Potential | Higher ceiling | Guaranteed floor |

| Stress Level | Variable to high | Low |

| Best For | Hands-on, prime locations | Busy, risk-averse, overseas |

Frequently Asked Questions

Is guaranteed rent just for desperate landlords?

Not at all, guaranteed rent has become mainstream among professional property investors. Many portfolio landlords use it strategically for certain properties while maintaining traditional lets for others. It’s about risk management and time allocation, not desperation.

What happens if AMS Housing Group faces financial difficulties?

AMS Housing Group maintains client money protection and is a member of relevant redress schemes. Rental payments are ring-fenced in separate accounts. We recommend always verifying these protections with any guaranteed rent provider before signing.

Will my mortgage lender allow guaranteed rent?

Most BTL lenders will consent to guaranteed rent arrangements, and some actively encourage them as they reduce default risk. However, you must obtain written consent before proceeding. Never assume consent — always ask explicitly.

Can you turn my house into an HMO?

Only if specifically agreed in the contract. Most guaranteed rent agreements for single-family homes maintain single-let arrangements. AMS Housing Group always clarifies intended use in writing before contract signature. For properties suitable for HMO conversion, we can discuss those options separately.

What if I want to sell during the guaranteed rent term?

Most contracts include break clauses allowing sale with vacant possession after appropriate notice (typically 3-6 months). AMS Housing Group can assist with viewings and marketing through our property sales service. Always review break clauses carefully before signing.

Do I still need landlord insurance?

Yes. Building insurance remains your responsibility as the property owner. AMS Housing Group typically handles contents and liability insurance for our operations. Always verify your policy covers company let arrangements.

Market data sources: ONS Private Rent Index September 2025, LandlordZONE Arrears Report Q2 2025, GOV.UK Renters’ Rights Bill guidance, industry research. Individual results vary by location and property type. This article provides general guidance and should not be considered financial or legal advice.