Last updated: February 2026

Right now, over 131,000 households across England are trapped in temporary accommodation. Councils spent a record £2.7 billion housing these families in the 2024/25 financial year alone, a 26% jump from the year before, and the numbers keep climbing. That is a crisis. And that is why councils across the UK are actively recruiting private landlords like you to help fill the gap.

If you have ever searched “how to rent my house to the council” or wondered “how much will the council pay to rent my property,” you are not alone. Thousands of landlords are weighing up whether a council letting scheme could offer them more security than the open market, particularly with Section 21 evictions disappearing in May 2026 and a raft of new regulations landing on private landlords.

We cover how council schemes actually work, what councils pay (with real Local Housing Allowance figures for 2025 to 2027), the incentives on offer, how to apply, and the honest pros and cons. Whether you own one buy-to-let in Birmingham or a portfolio across London, this is the breakdown you need before committing your property.

What does renting your property to the council actually mean?

When people talk about “renting your property to the council,” they are usually describing one of several arrangements where a local authority either becomes your tenant directly, guarantees your rental income, or nominates tenants for your property. The council’s motivation is straightforward: they need homes for families on their housing waiting list, and purchasing or building enough social housing takes years. Leasing from private landlords is faster and, compared to bed and breakfast accommodation at £100+ per night, significantly cheaper.

The demand is enormous. London alone had over 75,000 households in temporary accommodation by mid-2025. Outside the capital, cities like Derby had over 8,000 applicants on their housing register when they launched a new private sector leasing scheme in late 2025. Councils are not doing this reluctantly. They are actively spending money to attract landlords because the alternative costs far more.

Types of council rental agreements

There are three main ways councils work with private landlords. Each has different implications for your income, control, and responsibilities.

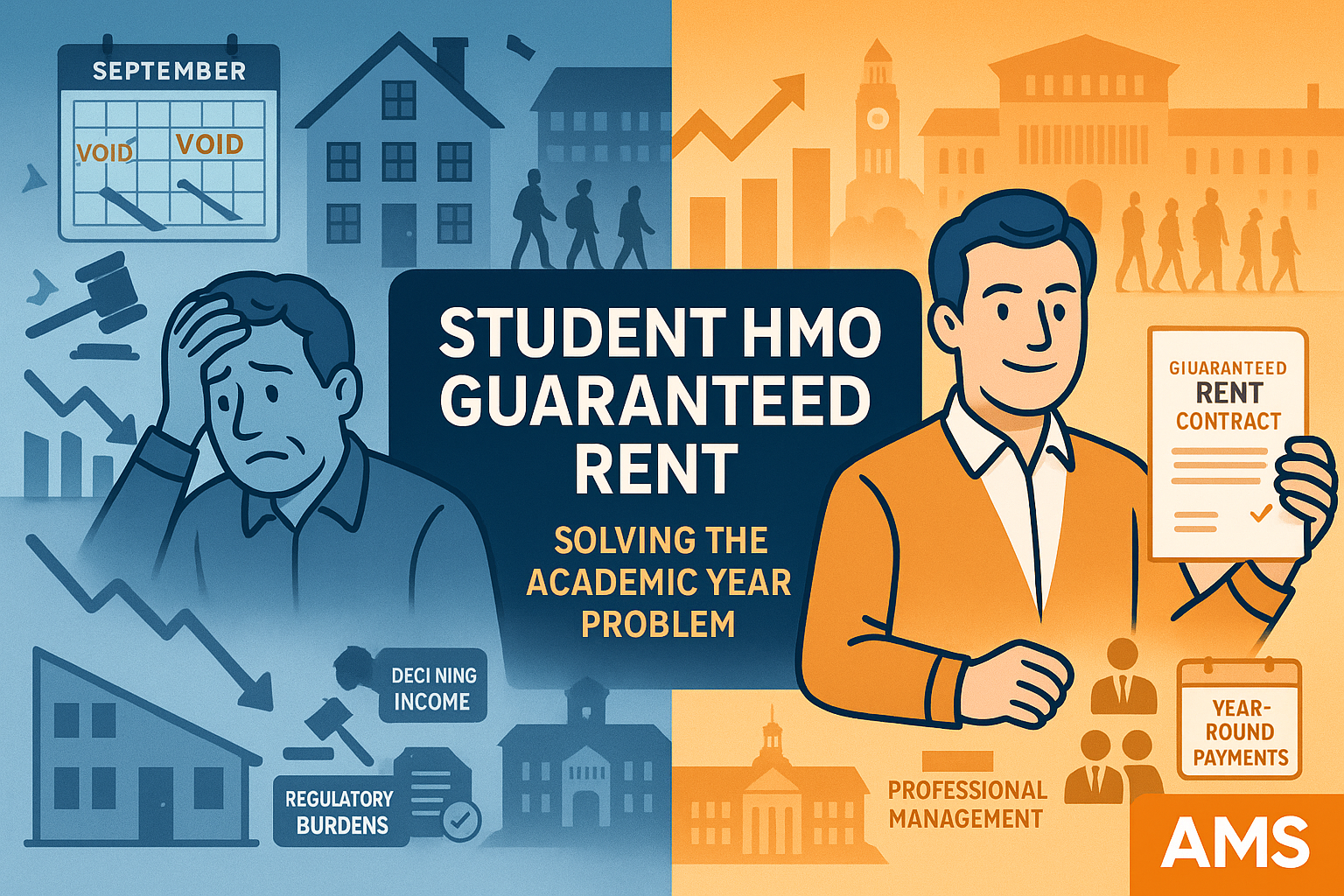

Private Sector Leasing (PSL) is the most hands-off option for landlords. The council takes a lease on your property, typically for 3 to 5 years (some councils offer 5 to 20 years). They become the legal tenant, manage the property day to day, handle repairs, find and manage the occupants, and pay you a guaranteed rent each month. You step back almost entirely. Cornwall, Derby, and many London boroughs run PSL schemes.

AST Nominations work differently. The council identifies and vets a tenant from their waiting list and nominates them to you. You, the landlord, grant the Assured Shorthold Tenancy directly and retain the standard landlord responsibilities. The council may offer a rent deposit guarantee or an incentive payment, but you manage the tenancy. Leicester’s letting scheme operates partly on this model.

Direct Let / Rent Guarantee is a middle ground. You let the property with a council-backed guarantee that your rent will be paid, even if the tenant falls into arrears. The council may also guarantee against property damage up to a certain value. You retain more control, but with a financial safety net.

| Feature | Private Sector Leasing (PSL) | AST nominations | Direct let / rent guarantee |

|---|---|---|---|

| Who holds the tenancy | Council | Landlord | Landlord |

| Typical lease length | 3 to 20 years | 6 to 12 months initially | 12 months+ |

| Property management | Council handles | Landlord handles | Landlord handles |

| Rent guarantee | Full, for entire lease term | Usually none | Yes, council-backed |

| Tenant selection | Council chooses | Council nominates, landlord approves | Varies |

| Landlord involvement | Minimal | High | Medium |

| Rent level | LHA rate or negotiated | LHA rate or market rate | LHA rate or close to it |

How much will the council pay to rent your property?

This is the question every landlord asks first. The short answer: most council schemes pay at or around the Local Housing Allowance (LHA) rate for your area, which is typically 10 to 30% below the open market rent. But the net income calculation is more nuanced than that headline figure suggests.

Understanding Local Housing Allowance (LHA) rates

LHA sets the maximum amount of housing benefit or Universal Credit housing element that can be paid towards rent in the private sector. It is calculated by the Valuation Office Agency based on Broad Rental Market Areas (BRMAs), geographic zones that group together areas with similar rental markets.

The critical point for 2025 to 2027: LHA rates are frozen. The government reset rates to the 30th percentile of local rents in April 2024, based on rental data from September 2023. Those same rates have been carried forward unchanged for 2025/26 and confirmed frozen again for 2026/27. That means the same figures apply for three consecutive years, even though actual market rents have risen roughly 14% since the data was collected, according to Citizens Advice.

For landlords considering council schemes, this freeze matters. The rent you are offered today will not increase for the duration of the freeze, and possibly not for the duration of your lease, depending on the terms.

Sample LHA rates by area (2025 to 2027)

These monthly figures are the same for 2024/25, 2025/26, and 2026/27 due to the freeze. They represent the maximum a council scheme would typically pay.

London BRMAs

| Area (BRMA) | 1 bed | 2 bed | 3 bed | 4 bed |

|---|---|---|---|---|

| Central London | £1,440 | £1,794 | £2,160 | £3,060 |

| Inner South East London | £1,296 | £1,550 | £1,950 | £2,625 |

| Outer South London | £950 | £1,200 | £1,499 | £1,949 |

| Inner West London | £1,347 | £1,622 | £2,048 | £2,547 |

| Outer West London | £999 | £1,298 | £1,473 | £1,798 |

Major cities outside London

| Area (BRMA) | 1 bed | 2 bed | 3 bed |

|---|---|---|---|

| Central Greater Manchester | £775 | £875 | £950 |

| Birmingham | £695 | £750 | £825 |

| Leeds | £347 | £673 | £773 |

| Bristol | £900 | £1,095 | £1,300 |

| Sheffield | £349 | £573 | £618 |

You can look up the exact LHA rate for your property’s postcode using the VOA LHA Direct tool or the GOV.UK LHA rate tables for 2026/27.

LHA rates vary significantly even within the same city. A property in central Manchester commands more than twice the LHA rate of one in Sheffield, despite both being in the north of England. Always check the specific BRMA for your postcode.

How council payments compare to market rent

At first glance, receiving 10 to 30% below market rent sounds unattractive. But that comparison ignores the costs and risks that vanish when a council guarantees your income. Let us work through a realistic example.

Worked example: 2-bed property in Outer South London

| Factor | Private letting | Council scheme (PSL) |

|---|---|---|

| Monthly rent | £1,500 (market rate) | £1,200 (LHA rate) |

| Annual gross rent | £18,000 | £14,400 |

| Void periods (8% average) | -£1,440 | £0 (guaranteed) |

| Letting agent fees (10% + VAT) | -£2,160 | £0 (council manages) |

| Tenant finding fees | -£600 (per new tenant) | £0 |

| Rent arrears (average 2 weeks/year) | -£692 | £0 (guaranteed) |

| Legal/eviction costs (amortised) | -£300 | £0 |

| Annual net income | £12,808 | £14,400 |

In this example, the council scheme delivers £1,592 more per year in net income despite the headline rent being £300 per month lower. The zero void periods and zero management costs make up the difference and then some.

This will not hold true for every property. Landlords who self-manage, keep their properties continuously occupied, and never face arrears will earn more on the open market. But for landlords who use agents, experience occasional voids, or want predictability, the council scheme often wins on the bottom line.

Council incentives and financial benefits for landlords

Beyond the guaranteed rent, many councils offer upfront incentives to attract landlords into their schemes. These vary widely by area, but the sums can be large.

Cash incentives of £5,000 to £15,000 are common for landlords joining PSL schemes, particularly in London boroughs under pressure to reduce temporary accommodation costs. Some councils pay this as a lump sum on signing; others spread it across the first year.

Empty homes grants can be even larger. Certain London boroughs offer up to £80,000 to bring a long-term empty property up to standard and into a council leasing scheme. Outside London, figures of £25,000 to £40,000 are typical for empty homes programmes.

Free insurance covering rent loss and tenant damage is included in many PSL schemes. This saves landlords several hundred pounds per year on specialist landlord insurance premiums.

Licensing fee exemptions apply in some boroughs with selective or additional licensing. If you lease to the council, you may be exempt from the licensing fee (which can be £500 to £900+ per property).

Free property management during the lease term means no agent fees, no tenant finding costs, and no day-to-day management burden. For landlords currently paying 10 to 15% of rent to a managing agent, that saving alone is worth thousands per year.

Real council schemes across the UK

Council schemes are not theoretical. These are real programmes operating right now.

London council schemes

London accounts for over half of all temporary accommodation placements in England, so boroughs here offer some of the most generous terms.

Waltham Forest runs a Private Sector Leasing scheme alongside borough-wide selective licensing (launched May 2025 with a £895 fee). Their PSL scheme offers guaranteed rent, full property management, and free insurance for participating landlords.

Greenwich operates a PSL scheme with LHA-rate rent, council management, and grants of up to £15,000 for landlords who need to bring properties up to the required standard.

Ealing offers PSL with full management and handles all tenancy paperwork. Their scheme is designed for landlords who want a completely hands-off arrangement.

Hounslow guarantees rent paid in advance for the duration of the PSL agreement. Their LHA rates for Outer West London start at £999 per month for a 1-bed property.

Enfield has invested heavily in its Housing Gateway programme, reducing households in emergency accommodation from around 300 to just over 100 through structured leasing arrangements with private landlords.

Outside London

Oxford runs a Rent Guarantee Service, backing private landlords who house tenants from the council’s waiting list with guaranteed rent and deposit protection.

Leicester offers multiple letting scheme tiers, including a 12-month rent guarantee, up to £1,000 incentive payment, a deposit guarantee worth one month’s rent, free tenant matching, and ongoing tenancy support. The council reports that 90% of tenancies placed through their scheme are still in place, and many landlords renew after the initial term.

Maidstone operates a 3 to 5 year PSL scheme for landlords willing to commit their properties longer term.

Cornwall’s PSL scheme offers 5-year leases with rent paid in advance and full council management.

Brighton and Hove runs a PSL specifically focused on housing families, with the council taking full responsibility for tenant management and property upkeep during the lease.

Derby approved a new PSL programme in late 2025, allocating £150,000 in capital and £200,000 in revenue for its 2026/27 rollout. The council calculated that PSL costs a fraction of bed and breakfast placements, which reached £8.1 million in 2024/25.

Sheffield’s council scheme includes damage liability coverage, giving landlords additional protection against property damage beyond normal wear and tear.

Wales: Leasing Scheme Wales

Leasing Scheme Wales deserves special mention. Originally piloted in a handful of areas, the Welsh Government extended the scheme to all 22 local councils. It is now a truly national programme.

The scheme offers 5 to 20 year leases with rent guaranteed at the LHA rate for the full term. Landlords receive grants of up to £5,000 to bring properties up to standard or improve their EPC rating to Band C. For empty properties, an additional grant of up to £25,000 is available to cover renovation costs.

During the lease, the council handles all management, repairs, gas and electrical safety, tenant support, and even council tax during void periods. The landlord’s only ongoing obligation is buildings insurance and mortgage payments. For landlords with suitable properties in Wales, it is hard to find a better deal anywhere in the UK.

Is your property eligible? Requirements and standards

Councils will not accept just any property. There are clear standards your home must meet before a council will agree to lease it or place tenants.

Property standards

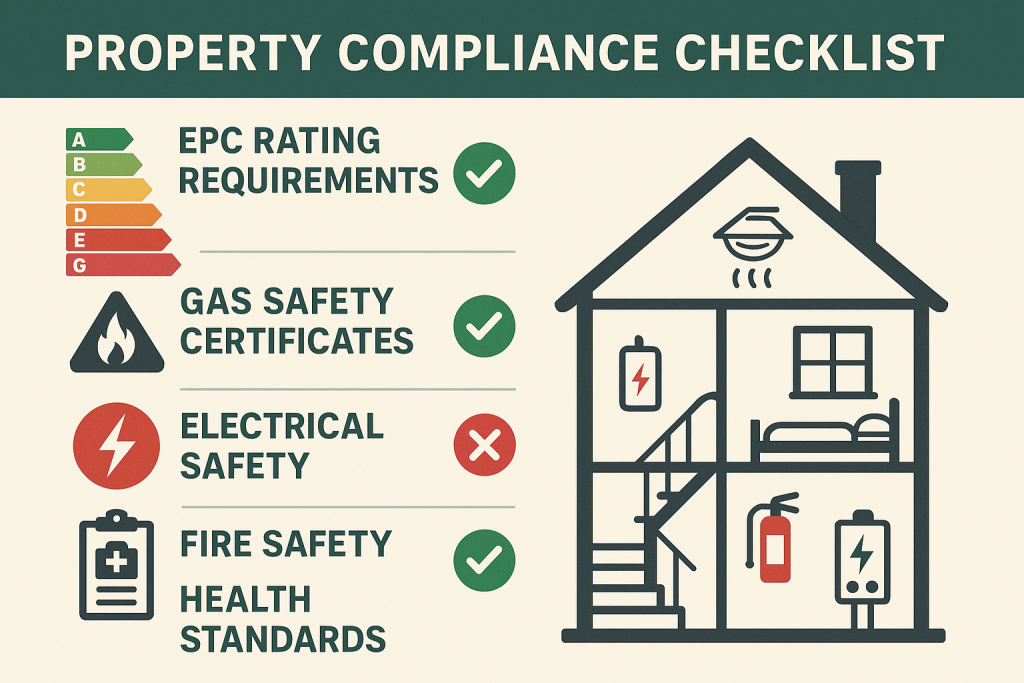

Your property must be free of Category 1 hazards under the Housing Health and Safety Rating System (HHSRS). This means no serious damp or mould, no dangerous electrics, no significant fire risks, no structural defects, and adequate heating throughout. The HHSRS assessment considers 29 potential hazards, and a single Category 1 hazard can disqualify your property until it is remedied.

The property must also have adequate kitchen and bathroom facilities, sufficient space for the intended household size, and reasonable insulation against external noise. The new Decent Homes Standard, which extends to the private rented sector from 2035, formalises these requirements, but councils are already applying similar criteria through their own inspections.

Required certificates

Before any council will proceed, you will need to provide:

- An Energy Performance Certificate (EPC) at minimum Band E. Current regulations under the Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 require Band E, but the government has confirmed that all private rented properties must reach Band C or equivalent by 1 October 2030, with a spending cap of £10,000 per property. Council schemes often prefer Band D or above already.

- A Gas Safety Certificate (CP12), renewed annually by a Gas Safe registered engineer.

- An Electrical Installation Condition Report (EICR), valid for 5 years, confirming the electrical installation is satisfactory.

- Working smoke alarms on every floor and carbon monoxide alarms in rooms with fixed combustion appliances (required under the Smoke and Carbon Monoxide Alarm (Amendment) Regulations 2022).

- Proof of property ownership (Land Registry title or mortgage statement).

- Valid buildings insurance for the property.

- Mortgage lender consent for council letting (more on this in the FAQ section).

Some councils will help you meet these requirements. Leasing Scheme Wales, for example, provides grants specifically to cover EPC upgrades and safety compliance work.

Step by step: how to let your property to the council

The process is more structured than private letting, but it is not complicated once you know what to expect.

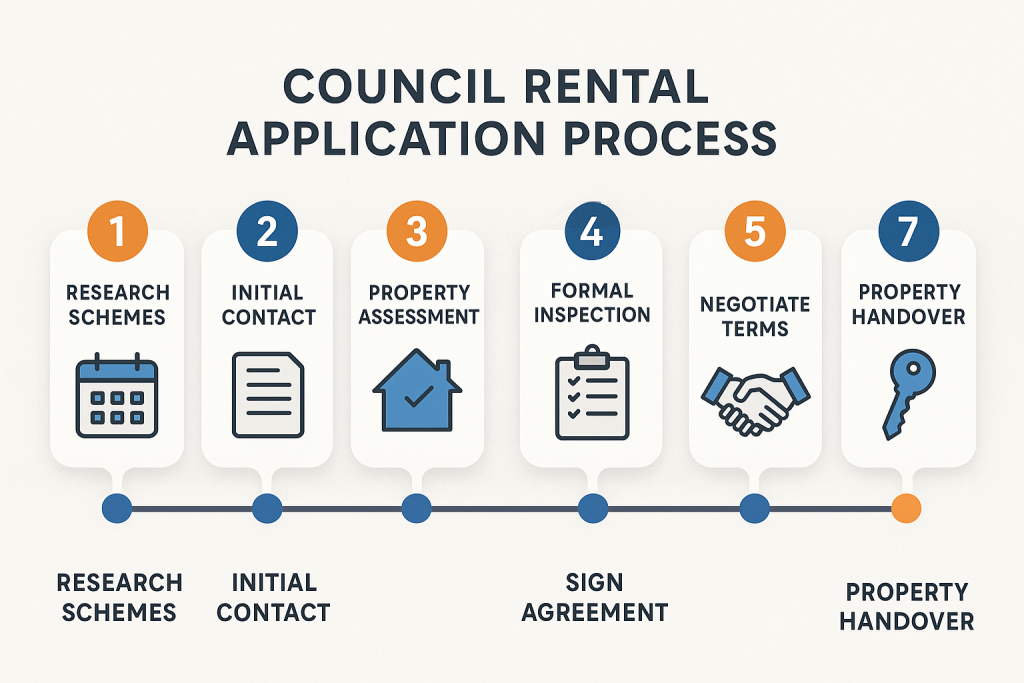

Step 1: Research your local council’s scheme. Start by searching “[your council name] private sector leasing” or “[your council name] landlord lettings scheme.” Most councils publish scheme details on their housing pages. If you cannot find anything online, call the council’s housing options team directly. Not every council runs a scheme, but most do in areas with significant housing pressure.

Step 2: Make initial contact. Reach out to the council’s lettings or housing team with basic details about your property: address, number of bedrooms, current condition, and your preferred arrangement. Expect a response within 5 to 10 working days, though some London boroughs respond faster due to urgency.

Step 3: Property assessment. The council will conduct an initial assessment, which may be a desktop review based on your property details and photos, or an in-person viewing. They are checking whether the property broadly meets their requirements before committing to a full inspection.

Step 4: Formal property inspection. A housing officer or contracted surveyor visits the property to conduct an HHSRS assessment and review your safety certificates. They will identify any work needed before the property can be accepted. This is where having your EPC, Gas Safety Certificate, and EICR ready saves time.

Step 5: Negotiate terms. Discuss the rent amount (usually based on LHA rates), lease length, maintenance responsibilities, the council’s obligations for repairs and tenant management, and any incentive payments. Get everything in writing.

Step 6: Sign the agreement. Review the lease or agreement carefully. Pay particular attention to clauses covering property condition at handback, your right to inspect, the process for lease termination, and the council’s repair obligations. It is worth having a solicitor review the agreement, especially for longer leases.

Step 7: Property handover. Complete a detailed inventory with photographs. Agree on final checks, confirm the payment schedule and method (most councils pay by bank transfer monthly in advance), and hand over the keys. The council will then arrange for the property to be occupied.

Realistic timeline

From first contact to a tenant moving in, expect the process to take 2 to 3 months for a council scheme. The main delays come from property inspections, any required remedial works, and council administrative processes.

By comparison, a private guaranteed rent company can typically complete the process in 2 to 4 weeks because they have fewer bureaucratic steps and can make faster decisions. If speed is a priority, this difference matters.

Council letting vs guaranteed rent companies vs private letting

This is the comparison most landlords really need. Each route has real advantages and trade-offs.

| Feature | Direct council (PSL) | Guaranteed rent company | Private letting (self-managed) |

|---|---|---|---|

| Rental rate | LHA rate (10-30% below market) | Between LHA and market rate | Full market rate |

| Contract length | 3 to 5 years (some 10 to 20) | 1 to 5 years (more flexible) | Rolling or periodic |

| Setup time | 2 to 3 months | 2 to 4 weeks | Immediate |

| Void risk | Zero | Zero | You bear it |

| Arrears risk | Zero | Zero | You bear it |

| Management | Council handles most | Company handles all | You handle all |

| Tenant selection | Council chooses | Company or council choose | You choose |

| Maintenance | Shared (varies by scheme) | Company handles | You handle |

| Flexibility | Very low | Medium | High |

| Exit ease | Difficult during term | Moderate | Easy |

| Incentives | Cash grants, free insurance | Varies by provider | None |

| Regulatory burden | Low (council manages compliance) | Low to medium | High (all on you) |

Which option suits you?

Choose direct council letting (PSL) if you want the longest possible guaranteed income, do not need your property back for several years, and value the financial incentives councils offer. This suits landlords with properties in areas where market rents are not dramatically above LHA rates.

Choose a guaranteed rent company if you want guaranteed income with more flexibility on lease length and faster setup. This is particularly attractive if you might need the property back sooner, or if you want a middle ground between council rates and market rates. See our comparison of guaranteed rent vs traditional letting for a detailed breakdown.

Choose private letting if you want maximum rental income, full control over tenant selection, and the flexibility to sell or repurpose your property at short notice. Be prepared to handle management, voids, arrears, and the full weight of incoming regulatory changes yourself.

The Renters’ Rights Act 2025: what it means for council letting

The Renters’ Rights Act 2025 received Royal Assent on 27 October 2025 and overhauls private renting law in England. Its provisions are rolling out through 2026 and beyond, and they affect every private landlord.

Section 21 “no fault” eviction is abolished from 1 May 2026. From that date, landlords can no longer serve a Section 21 notice to end a tenancy. All existing Assured Shorthold Tenancies convert to periodic assured tenancies. Serving a Section 21 notice on or after 1 May 2026 risks a civil penalty of up to £7,000. If you have already served a valid notice before that date, you must start possession proceedings by 31 July 2026 at the latest.

All tenancies become periodic. Fixed-term tenancies are abolished for new tenancies. Landlords who want possession must use Section 8 grounds, which require proving specific reasons such as rent arrears, antisocial behaviour, or the landlord’s intention to sell or move in. Court backlogs mean this process can take months.

Awaab’s Law currently applies to social housing (since October 2025), requiring landlords to investigate and address damp, mould, and serious hazards within strict timeframes. The Act contains provisions to extend this to the private rented sector, with consultation ongoing and implementation expected within the next one to two years.

Rent Repayment Orders have been expanded. Councils can now require landlords to repay up to 24 months’ rent for a wider range of offences, including failing to comply with improvement notices or operating unlicensed properties.

The Private Rented Sector Database launches in late 2026, requiring all private landlords in England to register themselves and their properties. A compulsory Landlord Ombudsman follows, with mandatory membership expected from 2028.

Why this makes council schemes more attractive

For landlords in PSL arrangements, many of these changes have limited practical impact. The council holds the tenancy and manages the property, so the compliance burden falls on them, not you. Council-managed properties are already expected to meet or exceed the standards the Renters’ Rights Act imposes.

Private landlords, by contrast, face the full force of every new requirement: no Section 21 safety net, mandatory database registration, ombudsman membership, potential Awaab’s Law obligations, and the risk of rent repayment orders for non-compliance. The regulatory gap between council-leased and privately-managed properties is widening, which is one reason more landlords are looking at council schemes seriously.

Benefits of renting your property to the council

The main advantages of council letting are:

- Guaranteed rental income paid monthly, even during void periods. No chasing tenants for late rent. No empty months between tenancies.

- Long-term stability. A 3 to 5 year lease (or longer) gives you predictable cash flow for years ahead, which is valuable for mortgage planning and financial forecasting.

- Professional property management at no cost to you. The council handles tenant communication, routine maintenance coordination, and compliance paperwork.

- No tenant finding or vetting burden. The council sources, references, and places tenants from their waiting list.

- Protection from rent arrears. The council pays you regardless of whether the occupant pays them.

- Financial incentives including cash payments, grants, and free insurance that are not available to private landlords.

- Reduced regulatory exposure under the Renters’ Rights Act. The council absorbs much of the compliance burden that would otherwise fall directly on you.

Risks and downsides you should know about

Council letting is not all upside. There are real disadvantages worth weighing.

Lower rent than market rates. LHA rates are already below market rent in most areas, and the freeze through March 2027 means they are falling further behind as market rents continue to rise. In high-demand areas, this discount can be substantial.

Long-term lock-in. PSL agreements typically run for a minimum of 3 to 5 years, and some are 10 to 20 years. Exiting early is difficult and may involve financial penalties. If your circumstances change, or if you want to sell the property, this inflexibility can be a serious problem.

Property condition concerns. While councils are obliged to return properties in good condition (minus fair wear and tear), the reality can be mixed. Some landlords report that council-managed properties experience heavier wear than privately let ones, and that the bureaucratic repair process can be slow, with decisions passing through multiple departments before anything happens.

Limited control over tenant selection. You have no say over who lives in your property. The council allocates tenants based on housing need, not on your preferences. For some landlords, this lack of control is uncomfortable.

Mortgage and insurance complications. Not all buy-to-let mortgage lenders are comfortable with council tenancies. Some view them as higher risk, and you may need to switch to a specialist product or get explicit lender consent. Similarly, your landlord insurance policy may need adjusting to cover council-placed tenants.

Slow council communication. Councils are large organisations with competing priorities. Getting a quick response to queries, arranging repairs, or resolving disputes can take longer than it would with a private letting agent or guaranteed rent company.

Tax and financial considerations

Council rental income is taxed in exactly the same way as any other rental income. There are no special tax advantages or disadvantages to letting through a council scheme.

Your rental income (including any council incentive payments) is added to your other income and taxed at your marginal rate: 20% for basic rate taxpayers, 40% for higher rate, or 45% for additional rate.

Section 24 mortgage interest restrictions apply in full. Since April 2020, individual landlords cannot deduct mortgage interest from rental income as an expense. Instead, you receive a 20% tax credit on the interest paid. This means higher and additional rate taxpayers pay more tax on the same rental income than they did before the restriction. For a higher rate taxpayer with £12,000 rental income and £8,000 mortgage interest, the effective tax bill roughly doubles compared to the pre-Section 24 position. The restriction applies regardless of whether you let privately or through a council. Landlords operating through a limited company are not affected, as companies can still deduct interest as a business expense.

Council incentive payments may be taxable. The treatment depends on the nature of the payment. A cash incentive for joining a scheme is likely to be treated as rental income. A grant specifically for property improvements may be treated differently. HMRC guidance is not always clear on this, so it is worth discussing with an accountant, particularly for larger sums.

Making Tax Digital (MTD) becomes mandatory for landlords with gross qualifying income over £50,000 from 6 April 2026. The threshold drops to £30,000 from 6 April 2027, and to £20,000 from 6 April 2028. If your rental income (combined with any self-employment income) exceeds these thresholds, you must keep digital records and submit quarterly updates to HMRC using compatible software. This applies whether you let privately or through a council.

Buildings insurance is your responsibility throughout any council lease. If the property is furnished, you should also consider contents insurance, though many PSL schemes require the property to be let unfurnished.

Frequently asked questions

How much does the council pay to rent a house in my area?

Council schemes typically pay at or near the Local Housing Allowance rate for your Broad Rental Market Area. You can find your exact rate by entering your postcode at lha-direct.voa.gov.uk. Rates are currently frozen at April 2024 levels through March 2027. As a rough guide, a 2-bed property ranges from around £573 per month in Sheffield to over £1,794 per month in Central London.

Is it worth renting my house to the council?

It depends on your priorities. If you value guaranteed income, zero management hassle, and long-term stability over maximising headline rent, then yes, it is often worth it. The worked example earlier in this guide shows how a council scheme can deliver higher net income than private letting once you account for voids, agent fees, and arrears. It is less suitable if you need flexibility, want maximum rent, or plan to sell within the next few years.

Can I rent multiple properties to the council?

Yes. Most councils welcome portfolio landlords and some actively prefer them because a single relationship can house multiple families. If you have several properties that meet the required standards, you may be able to negotiate better terms on a portfolio basis.

What happens if the council wants to end early?

The lease agreement will specify the terms for early termination. Councils rarely end leases early because they need the accommodation. If they do, most agreements require a notice period (typically 3 to 6 months) and may include a financial settlement. Read the termination clauses carefully before signing.

Can I inspect my property during a council tenancy?

Yes, but with reasonable notice. Most PSL agreements include a clause allowing landlord inspections, typically with 24 to 48 hours’ written notice. The council will usually coordinate access. In practice, some landlords report that arranging inspections can take longer than with a private tenant due to council administrative processes.

Do council tenants cause more damage than private tenants?

This is a common concern, but the evidence is mixed. Council-placed tenants are housed because of need, not because they are problematic. Many are working families who simply cannot afford market rents. That said, some landlords do report heavier wear and tear, particularly with larger families in smaller properties. The key protection is the PSL agreement, which should obligate the council to return the property in the same condition (allowing for fair wear and tear). Make sure this clause is in your agreement and document the property thoroughly at handover.

Can I sell my property during a council lease?

Technically yes, but practically it is complicated. The PSL agreement is a lease, and it transfers to any new owner. This limits your pool of potential buyers to investors willing to take on the existing council lease, which typically means accepting a lower sale price. Selling with vacant possession usually requires waiting until the lease ends. If you think you might sell within the lease term, factor this into your decision before signing.

What mortgage do I need for council letting?

You need a buy-to-let mortgage, and critically, you need your lender’s consent for council or local authority letting. Not all buy-to-let products permit this. Some lenders specifically exclude council tenancies or charge a higher rate. Before committing to a scheme, check with your lender or broker. If you need to remortgage, specialist lenders such as those serving the social housing sector are more accommodating.

How do I find my local council’s letting scheme?

Search for “[your council name] private sector leasing” or “[your council name] landlord lettings scheme.” You can also call the council’s housing options team directly. The National Residential Landlords Association (NRLA) maintains information on council schemes, and your local landlord forum or property network may have first-hand recommendations.

Will the Renters’ Rights Act affect my council lease?

If you are in a PSL arrangement where the council holds the lease, the Act’s main changes (Section 21 abolition, periodic tenancies, landlord database) have limited direct impact on you. The council, as the tenant, manages the occupancy. However, if you are in an AST nomination arrangement where you hold the tenancy directly, the full Act applies to you. The type of council arrangement you choose matters here.

Is the guaranteed rent really guaranteed?

For PSL schemes, yes. The council is contractually obligated to pay you for the full lease term regardless of whether the property is occupied or the occupant pays. Councils are public bodies with statutory obligations, so the risk of non-payment is extremely low. For rent guarantee schemes (as opposed to full PSL), the guarantee is typically backed by a bond or insurance arrangement, and the terms and limits should be spelled out in your agreement.

What are local housing allowance rates in my area?

LHA rates vary by Broad Rental Market Area and property size. The quickest way to find your rate is the VOA postcode lookup tool. You can also view the full rate tables on GOV.UK. Remember that current rates are frozen through March 2027 and are based on September 2023 rental data, so they may be significantly below current market rents in your area.

Summary: is council letting right for you?

Council letting suits landlords who prioritise income security over income maximisation. If you want guaranteed rent, no management responsibilities, and long-term stability, and you are comfortable with below-market rates and limited flexibility, a council scheme is worth serious consideration. It works particularly well for landlords who are concerned about the regulatory burden of the Renters’ Rights Act, those who have experienced void periods or arrears, and those with properties in areas where LHA rates are close to market rent.

It is less suitable for landlords who want to maximise every pound of rental income, need the option to sell or repurpose their property at short notice, prefer to choose their own tenants, or own properties in areas where market rent is dramatically above LHA rates.

The practical first step: look up the LHA rate for your property’s postcode, compare it to your current net income (after voids, fees, and arrears), and contact your local council’s housing team to ask about their specific scheme terms. That comparison, based on your real numbers, will tell you more than any general guide can.

For landlords who want the security of guaranteed rent with more flexibility than most council schemes offer, shorter contract terms, and a faster setup process, AMS Housing Group provides a guaranteed rent service designed specifically for private landlords. You can get a free, no-obligation property valuation to see how your property’s guaranteed rent compares to both council and open market rates.