Last Updated: October 17, 2025

Table of Contents

Key Takeaways:

- Rent Guarantee Insurance covers unpaid rent and legal costs but has significant limitations, including 3-4 month payment gaps, no void period coverage, and strict claim requirements.

- The rental market, with the abolition of Section 21, makes non-paying tenant issues longer and more expensive, increasing the need for protection.

- Guaranteed Rent Schemes are presented as a superior alternative, eliminating all risk, management, and stress for a fixed percentage of the market rent. This article provides a detailed comparison to help landlords make an informed decision.

The phone call comes at 10pm on a Sunday. Your tenant—who’s been in the property for eight months—hasn’t paid rent in two months. They’re not answering calls. The arrears are now £2,400, and you’ve got a mortgage to cover.

This nightmare scenario is becoming increasingly common. In 2025, 37% of UK landlords experienced late rent payments, and 30% dealt with rent arrears. With the average UK rent now sitting at £1,313 per month, two months of missed payments can devastate your cash flow. Add in the new Renters’ Rights Bill—which abolishes Section 21 and extends notice periods to four months—and suddenly the stakes are even higher.

Enter rent guarantee insurance: a policy designed to cover your losses when tenants stop paying. But here’s the critical question most landlords don’t ask until it’s too late: Is insurance really the best way to protect your rental income?

In this comprehensive guide, we’ll break down everything you need to know about rent guarantee insurance; the costs, coverage, major UK providers, and hidden limitations. More importantly, we’ll explore why thousands of savvy landlords are switching to guaranteed rent schemes instead, eliminating the hassle of claims, waiting periods, and void periods entirely.

What is Rent Guarantee Insurance?

Rent guarantee insurance is a policy that protects landlords against financial losses when tenants fail to pay rent. Think of it as a safety net—when rent payments stop, the insurance steps in to cover the shortfall and associated legal costs.

Here’s how it typically works in the UK market: You pay an annual premium, usually £160-£300 or 5-7% of your annual rental income. In return, if your tenant falls into arrears, the insurer will cover missing rent payments (typically up to £2,500 per month for 6-12 months) and legal expenses for eviction proceedings (usually £50,000-£100,000 in coverage).

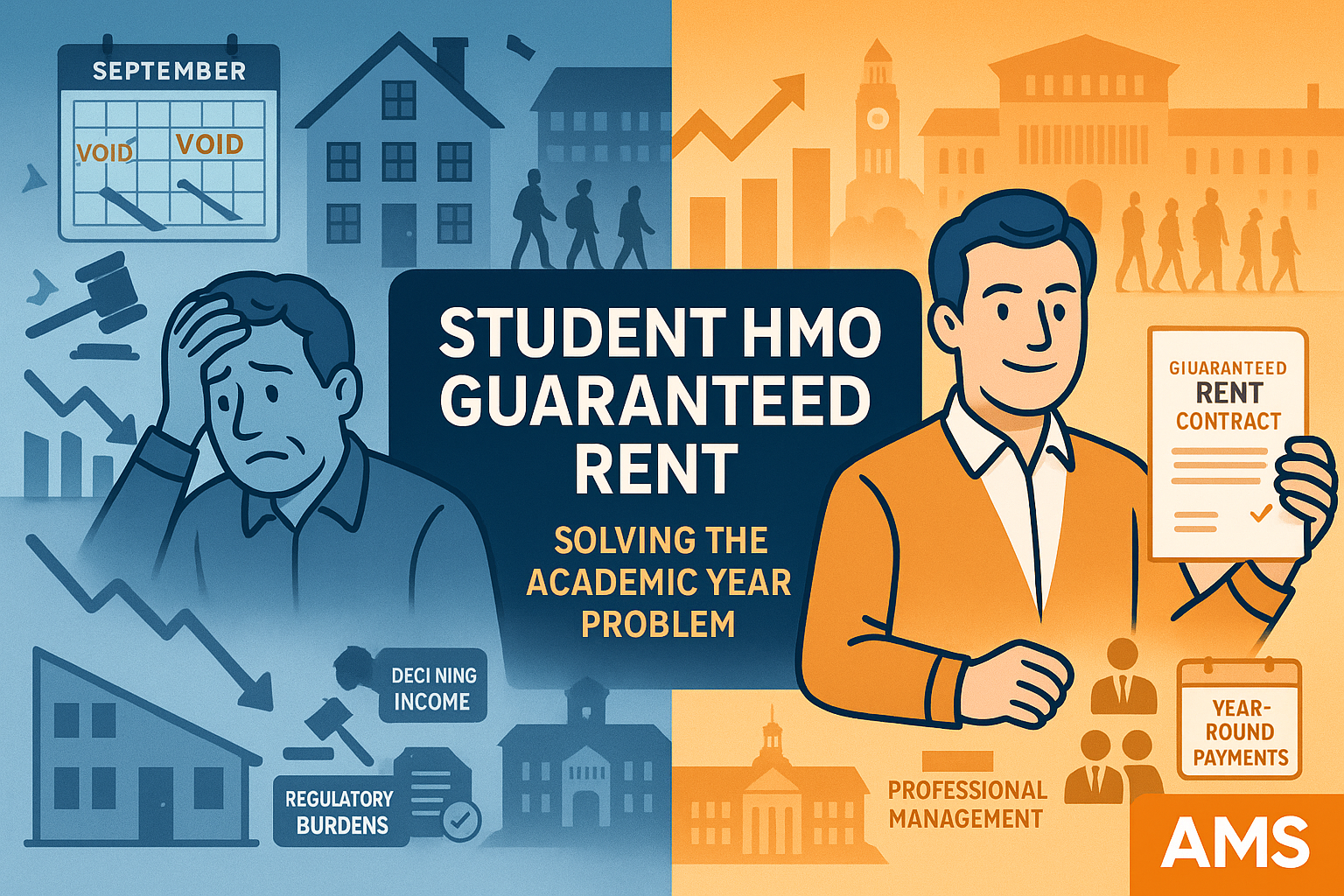

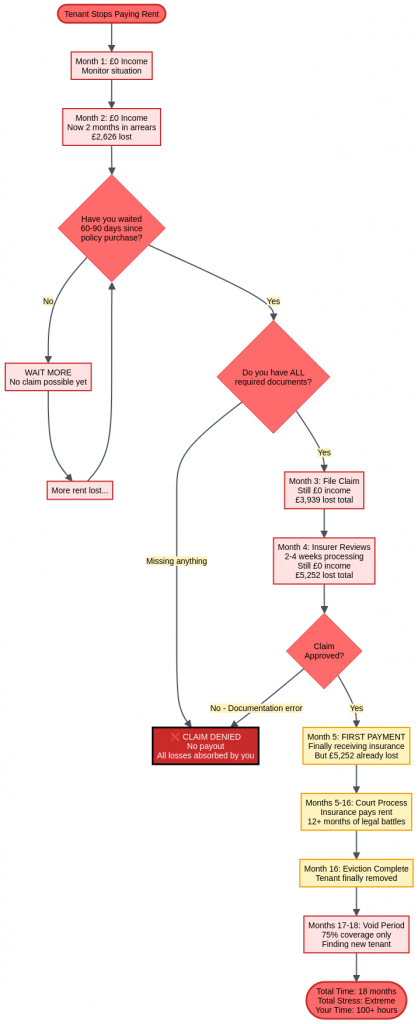

But there’s a catch—actually, several catches. The visual below shows the timeline reality.

Image: A timeline comparison showing the significant delays in receiving funds from rent guarantee insurance versus the consistent payments of a guaranteed rent scheme.

The policy doesn’t kick in immediately. Most UK providers require your tenant to be at least two months in arrears before you can make a claim. On top of that, there’s usually a 60-90 day waiting period from when you purchase the policy (though some insurers waive this if you buy within 10 days of the tenancy starting).

So if your tenant stops paying in month three, you’re typically looking at four to five months of unpaid rent before you see a penny from the insurer. At £1,313 per month average rent, that’s over £5,000 in losses before the policy even activates.

Major UK providers dominate the market. Alan Boswell offers policies from around £195 annually with coverage up to £2,500 per month. HomeLet, one of the most recognised names, provides similar coverage alongside their tenant referencing services. Legal & General, Total Landlord, and Superscript round out the major players, each with slightly different terms and pricing structures.

The insurance typically covers you if a tenant defaults on rent, refuses to leave after notice is served, or fights the eviction in court. It also includes legal representation and covers court costs—essential protection given that court delays for evictions now stretch beyond 12 months in many areas.

What makes rent guarantee insurance particularly relevant in 2025 is the changing legislative landscape. With the Renters’ Rights Bill abolishing Section 21 “no-fault” evictions and requiring landlords to prove three months of arrears (up from two), the risk of prolonged non-payment has increased significantly. You’re now looking at a minimum of four months notice plus 12+ months of court delays, meaning a non-paying tenant could remain in your property for well over a year.

That’s the theory, anyway. The reality—as we’ll explore—is more complicated.

How Much Does Rent Guarantee Insurance Cost?

Let’s talk numbers, because understanding the true cost of rent guarantee insurance requires looking beyond the premium.

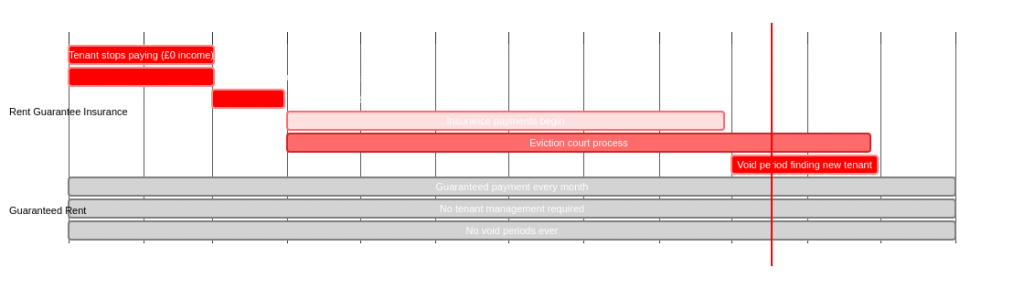

Image: The true cost of rent guarantee insurance often includes thousands in uncovered losses, far exceeding the simple annual discount of a guaranteed rent scheme.

Most UK insurers offer two pricing structures: a flat annual fee or a percentage of your annual rental income. The flat-fee option typically ranges from £160 to £300 per year, depending on the rental value and coverage level. For a property generating £1,313 per month in rent (the current UK average), you’re looking at roughly £195-£250 annually with providers like Alan Boswell.

The percentage-based model usually costs 5-7% of your annual rent. For that same property bringing in £15,756 annually, you’d pay £788-£1,103 per year. This option scales with your rent, which can be beneficial for lower-rent properties but expensive for high-value London properties.

But here’s the calculation most landlords forget: The cost isn’t just the premium. It’s the premium plus the waiting period plus the two months of arrears you need to accumulate before claiming. For a detailed breakdown of all landlord costs, see our dedicated guide.

What Does Rent Guarantee Insurance Cover?

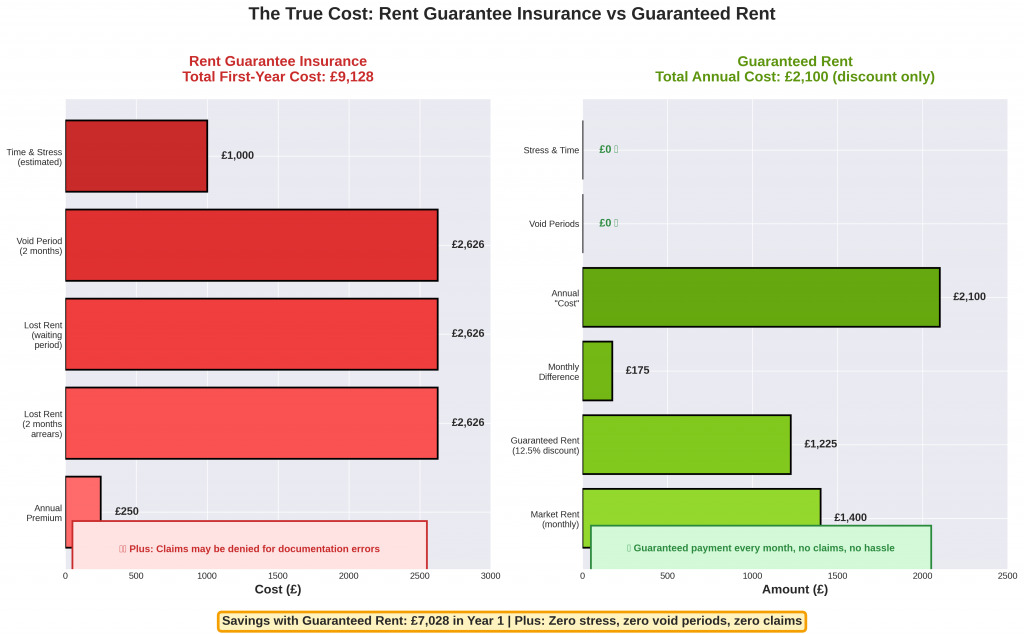

When rent guarantee insurance works as intended, it provides substantial financial protection. Understanding exactly what’s covered helps you evaluate whether it meets your needs.

Missing rent payments and legal expenses coverage are the core benefits. However, it’s what the insurance doesn’t cover that often surprises landlords.

Image: Rent guarantee insurance leaves significant gaps in protection, most notably void periods and the initial months of arrears, which are fully covered by guaranteed rent schemes.

What Doesn’t Rent Guarantee Insurance Cover?

This is where rent guarantee insurance reveals its limitations—and where many landlords experience unpleasant surprises.

•Void Periods: Not covered. At all. You are completely exposed between tenancies.

•Pre-existing Arrears: Not covered. You cannot insure a problem that has already started.

•Property Damage: Not covered. This requires separate landlord insurance.

•Compliance Failures: Your claim will be denied. Missing landlord certificates or other paperwork errors are a common reason for denied claims.

•The First 2 Months of Arrears: You must absorb this loss before you can even begin a claim.

•The 60-90 Day Waiting Period: You absorb this loss as well. In total, you are often out of pocket for 4-5 months.

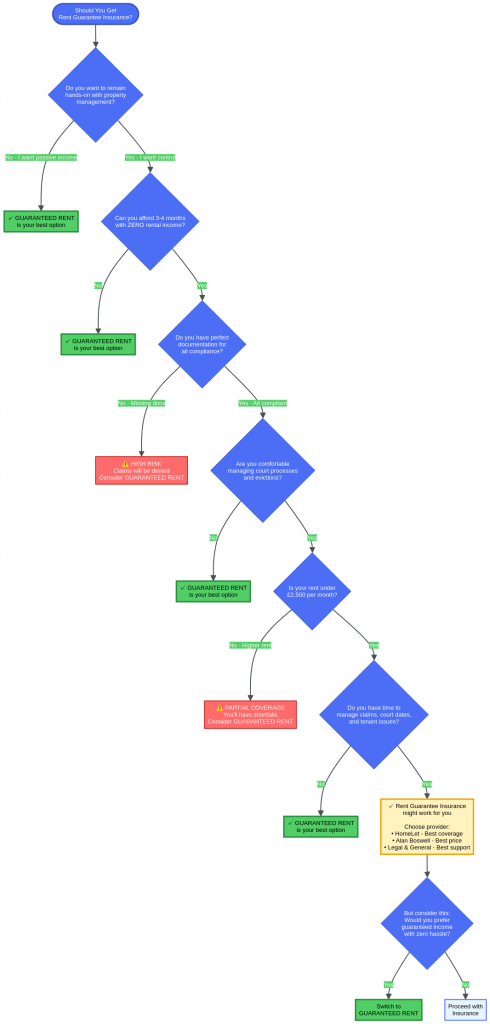

Is Rent Guarantee Insurance Right For You? A Decision Framework

For landlords who are still unsure, this decision flowchart can help you determine the best path forward based on your goals and risk tolerance.

Image: This decision tool helps you choose the right protection by weighing your desire for hands-on management against your need for financial certainty.

Rent Guarantee Insurance vs Guaranteed Rent Schemes

This is the critical comparison. While insurance is a reactive product you buy hoping never to use, guaranteed rent is a proactive service that eliminates the risk entirely. We have a detailed article comparing guaranteed rent vs traditional letting that explores this further.

| Feature | Rent Guarantee Insurance | Guaranteed Rent Scheme (AMS) |

| Payment timing | After 2 months arrears + 60-90 day waiting period | Every month on time, guaranteed |

| Void periods | NOT covered | Fully covered—we pay even when property is empty |

| Who manages tenants | You do | We handle everything |

| Claims process | File claims, provide evidence, wait for approval | None—automatic payment to your account |

| Property management | Your responsibility | Fully handled by us via our property management service |

| Cost | £160-300/year premium + uncovered losses | 10-15% below market rent, but 100% reliable income |

| Your time investment | High (managing claims, tenants, legal process) | Zero (we handle everything) |

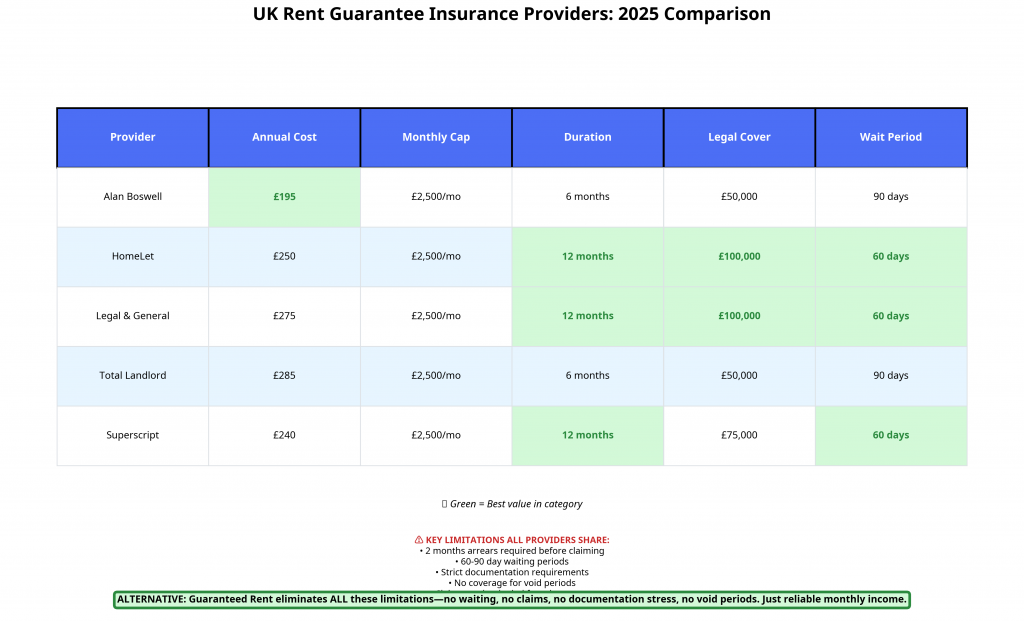

How to Choose a Rent Guarantee Insurance Provider

If you decide insurance is the right path, it’s crucial to compare providers carefully. Here is a summary of the major players in the UK market.

Image: A direct comparison of major UK insurance providers highlights key differences in cost, coverage, and limitations, helping you make an informed choice.

When choosing, ask providers tough questions about their claim denial rates, average payout times, and specific documentation requirements.

Frequently Asked Questions (FAQ)

How long does an insurance claim take?

Realistically, you should expect to be without rental income for 3-5 months from the first missed payment before an insurance claim begins to pay out. The process is long and requires patience.

Image: The insurance claims process is a long and stressful journey with multiple points of failure. Guaranteed rent skips this entirely.

What’s the difference between rent guarantee insurance and guaranteed rent?

Rent Guarantee Insurance is a reactive safety net. You pay a premium to protect against a specific problem (rent default), but you still manage the property and absorb many of the associated costs and risks.

Guaranteed Rent is a proactive service. You hand over all management and risk to a company like AMS Housing Group. In exchange for a percentage of the market rent, you receive a guaranteed payment every month, no matter what.

Do I still need landlord insurance?

Yes, absolutely. Rent guarantee insurance only covers rent. You still need a comprehensive landlord insurance policy to protect against building damage, liability, and other essential risks.

Conclusion: Making the Smart Choice for Your Rental Income

Rent guarantee insurance serves a purpose. For hands-on landlords with the time and cash reserves to manage its limitations, it offers a valuable safety net.

However, the 2025 rental landscape, shaped by the Renters’ Rights Bill, has made the process of dealing with non-paying tenants longer and more arduous than ever. The gaps in insurance coverage—void periods, waiting times, claim denials—are now more significant risks.

For landlords who value their time, desire truly passive income, and require absolute certainty, the choice is clear. Guaranteed rent is not just an alternative to insurance; it’s a fundamental upgrade to the landlord experience.

Skip the Insurance Hassle—Get Guaranteed Rent with AMS Housing Group

If you own property in Greater London or Essex and you’re tired of tenant worries, void periods, and income uncertainty, we have a better solution.

AMS Housing Group provides guaranteed rent that pays you reliably every month for 3-5 years—no claims, no hassle, no tenant management, no void periods. We handle everything whilst you receive predictable monthly income without lifting a finger.

Ready to transform your rental income from stressful to stress-free?

Contact AMS Housing Group today for a free property valuation and discover exactly how much guaranteed monthly income your property could generate. Your last tenant problem could be behind you within weeks.