Last Updated: 25th September 2025 | Reading Time: 12 minutes

Table of Contents

Breaking: With 2.2 million students needing accommodation in 2026 and the Renters Rights Act ending fixed-term tenancies, student HMO landlords face an unprecedented crisis. Here’s how guaranteed rent schemes are revolutionizing the student property market.

Picture this: It’s late May 2026. Your student tenants have just informed you they’re leaving for the summer – permanently. Under the new rules, they only need to give two months’ notice, even mid-academic year. Your carefully planned September-to-June rental model? Destroyed. Your mortgage payment? Still due every month.

Welcome to the new reality of student HMO investing. But there’s a solution that’s turning chaos into opportunity, and smart landlords are already making the switch.

The Student Housing Crisis: By The Numbers

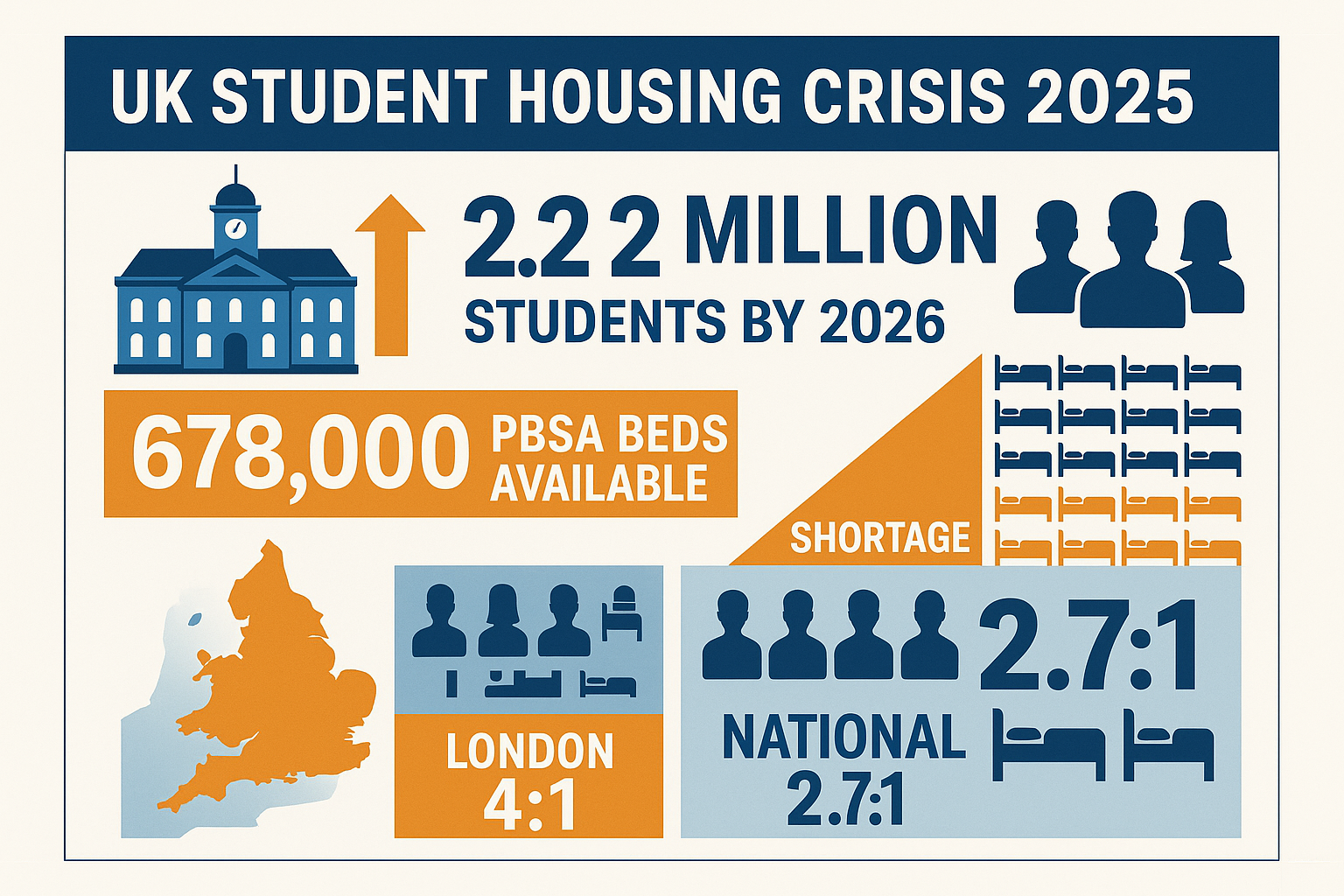

The UK student accommodation market is experiencing a perfect storm. With nearly 2.2 million students needing accommodation by 2026 and only 678,000 purpose-built beds available, the pressure on private HMO landlords has never been greater [1].

Consider these sobering statistics:

- 621,373 bed shortfall projected for 2026

- 15% rent increase in just two years

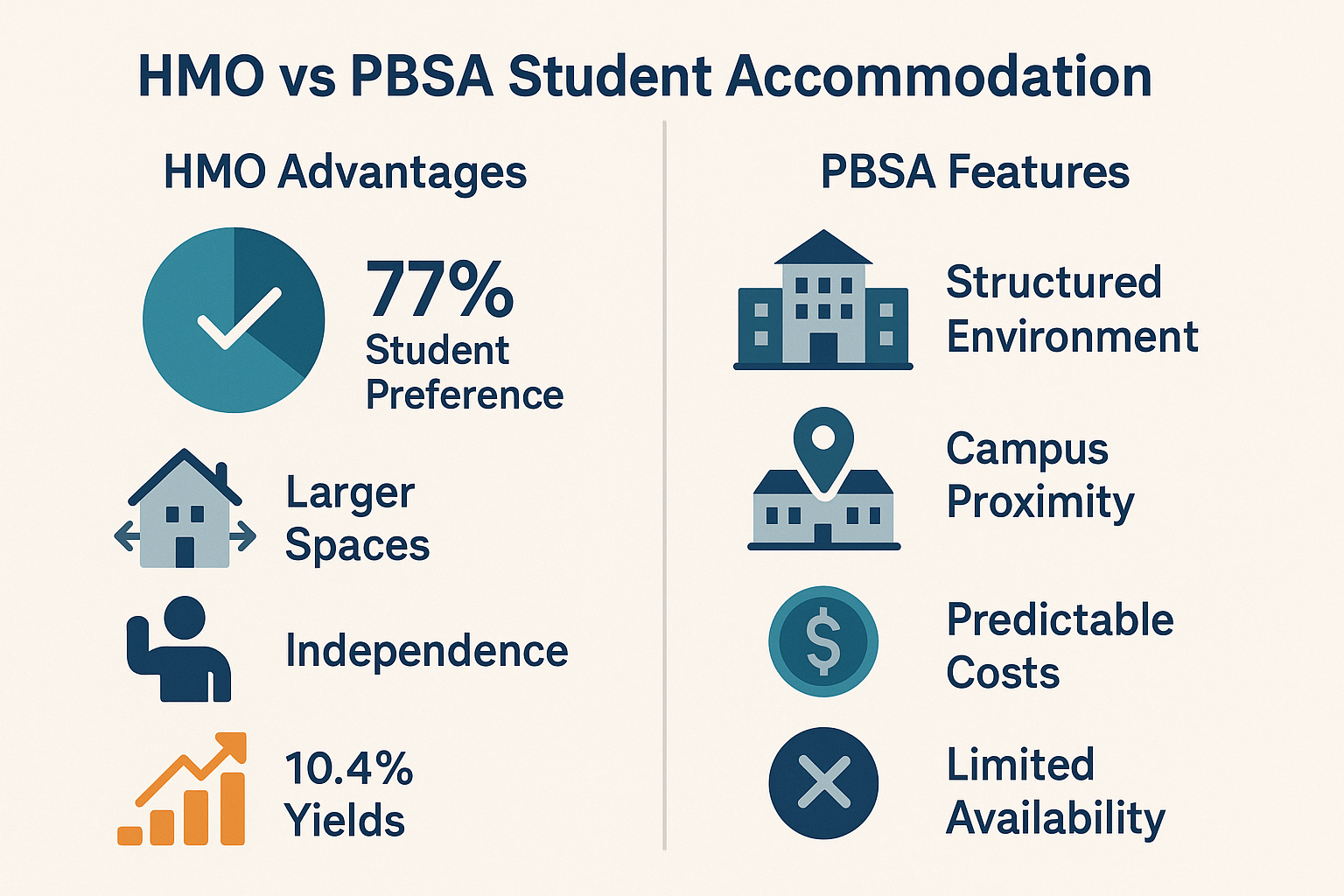

- 77% of students rely on private HMOs over university halls [2]

- Average student accommodation costs: £13,762 annually in London

- 74% of student landlords with properties below EPC C considering selling

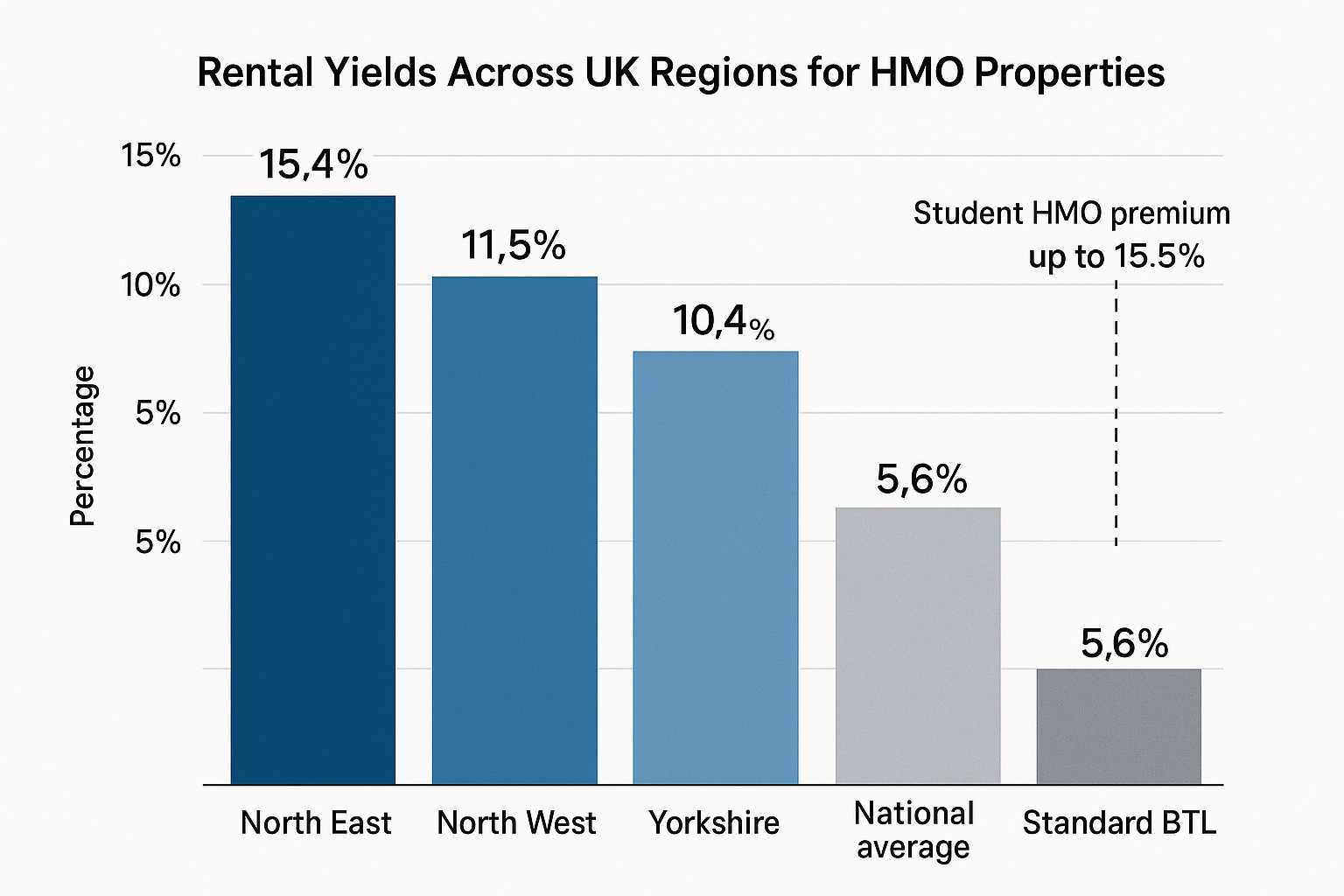

The demand is overwhelming. In cities like London, there’s a 4:1 student-to-bed ratio. Liverpool’s student HMOs achieve 11.5% yields [3]. Yet landlords are exiting the market in droves. Why? Because the traditional student letting model is broken.

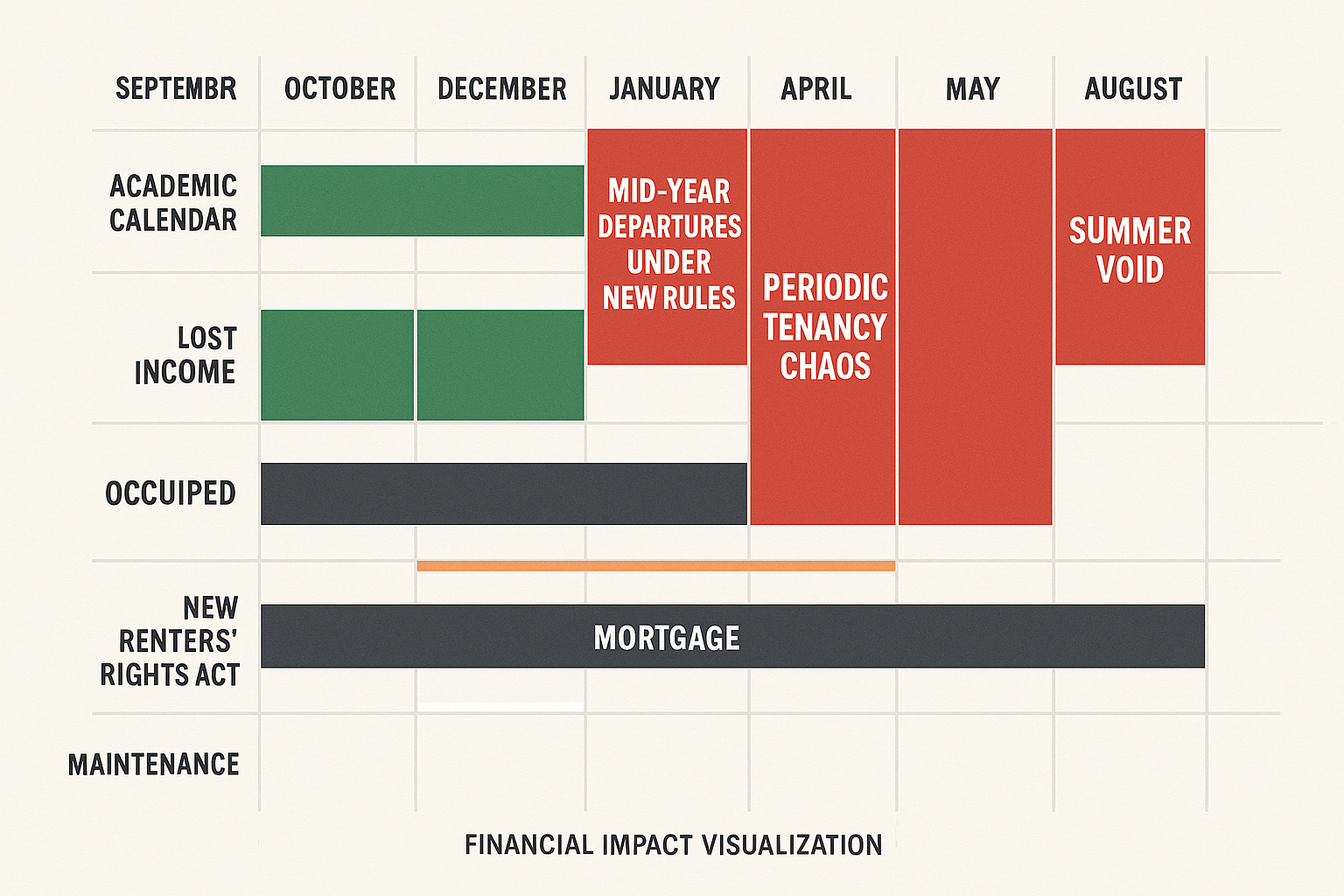

The Death of the Academic Year Model

What’s Actually Changing

The Renters Rights Bill doesn’t just tweak the rules – it obliterates the foundation of student letting as we know it.

The Old World (Pre-2026):

- Fixed 12-month contracts aligned with academic years

- Students committed September to August

- Predictable void periods for maintenance

- Group responsibility for rent

The New World (Post-2026):

- All tenancies become periodic (rolling monthly)

- Students can leave with 2 months’ notice anytime

- Mid-year departures destroy group dynamics

- Impossible to guarantee September starts

The Ground 4A “Solution” (That Isn’t)

Yes, the government introduced Ground 4A – a mandatory possession ground for student HMOs. But here’s what they’re not telling you:

- Only applies to 3+ bed HMOs (not 1-2 bed student properties)

- Requires court proceedings (add 33+ weeks)

- Must prove student status for all tenants

- Doesn’t guarantee new tenants will be students

As one Leeds landlord told us: “Ground 4A is a band-aid on a severed artery. It doesn’t solve the fundamental problem of students being able to leave whenever they want.”

For more detailed information on the eviction process under the new rules, see our comprehensive guide on how to evict a tenant in the UK.

The Hidden Costs of Student HMOs

The Summer Void Nightmare

Let’s talk about what actually happens during those “empty” summer months:

Traditional Student Let Reality:

- 6-8 week void minimum (June 30 – September 1)

- Lost income: £5,395 on average property

- Can’t rent to professionals (students return in September)

- Essential maintenance crammed into tiny window

- Still paying mortgage, insurance, utilities

Understanding the full scope of landlord costs is crucial when calculating the true profitability of student HMOs.

The International Student Crisis

Remember when international students paid 6-12 months upfront? That’s now illegal. Maximum one month in advance. Period.

New Problems:

- Can’t provide UK guarantors

- Banks won’t accept overseas guarantors

- Commercial guarantor services cost 5-7 weeks’ rent

- Many simply can’t secure accommodation

For landlords dealing with international students, understanding what is a guarantor for rent and the risks of being a guarantor for rent becomes essential.

The Group Dynamic Disaster

Sarah manages 12 student HMOs in Manchester. Her nightmare scenario, now common:

“Five friends sign in January for September. By May, two have fallen out. Come September, one doesn’t return to uni, another found cheaper accommodation. The remaining three can’t afford the house. Under periodic tenancies, they all leave with two months’ notice in November. I’m left with an empty 5-bed in the middle of the academic year.”

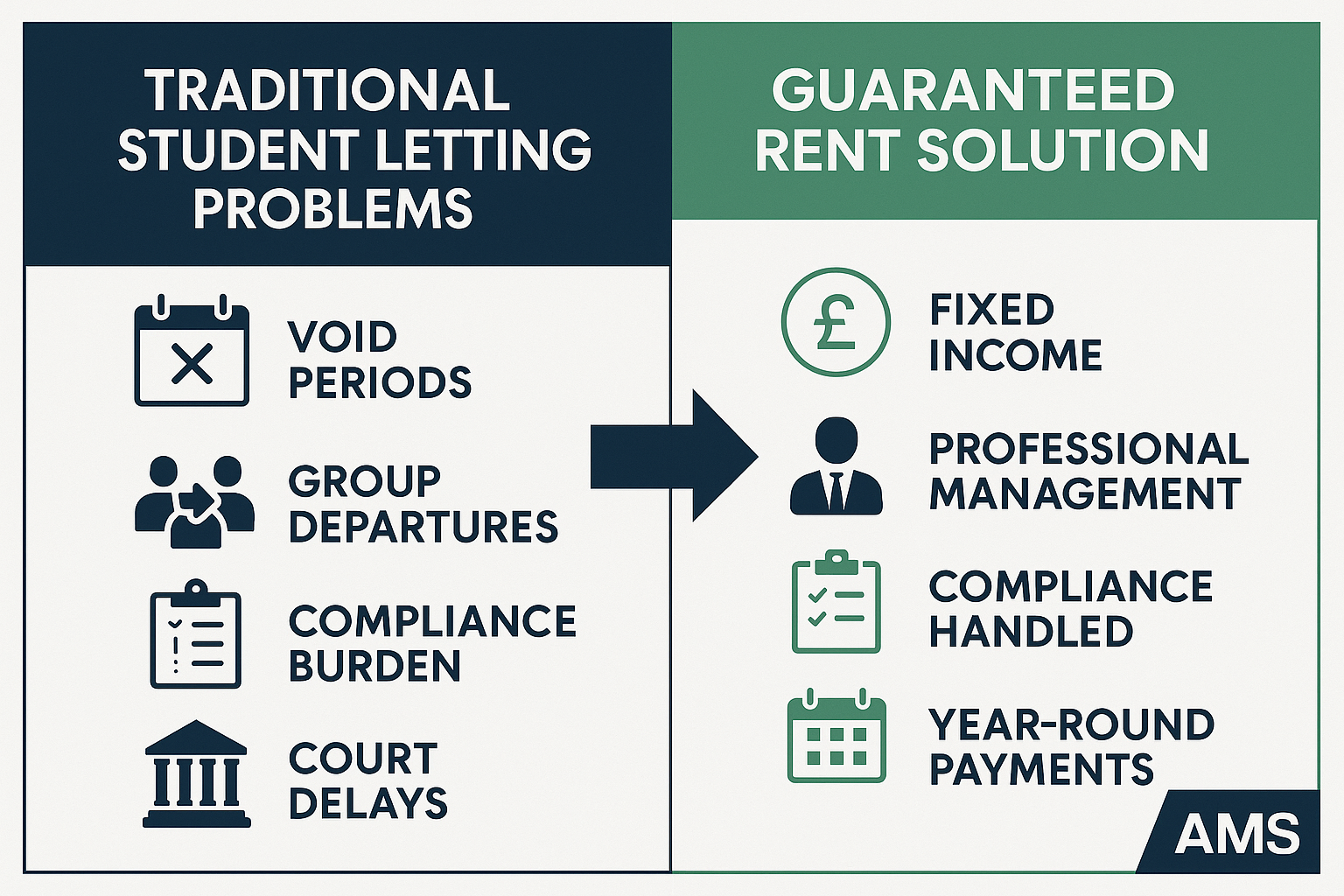

Guaranteed Rent: The Game-Changing Solution

How Student HMO Guaranteed Rent Actually Works

Forget everything you know about traditional student letting. Guaranteed rent operates on a completely different model:

You provide: The property

They provide: Everything else

Your reality:

- Fixed monthly payment, 12 months a year

- Payment starts from contract signing

- Summer voids? Their problem

- Student dropouts? Their problem

- Damage claims? Their problem

- HMO compliance? They handle it

For a detailed explanation of how this works, read our guide on understanding how guaranteed rent works.

The Financial Truth (With Real Numbers)

Let’s compare a real 5-bed student HMO in Leeds:

Traditional Student Letting

Market rent: £166/week per room

5 rooms × £166 × 52 weeks = £43,160 potential

Reality deductions:

- 6-week summer void: -£4,980

- 10% management fees: -£3,818

- Maintenance/repairs: -£2,000

- Risk of mid-year void: -£3,320

- Guarantor service fees: -£500

Actual annual income: £28,542 (and that's if everything goes perfectly)Guaranteed Rent (at 80% of market)

Guaranteed monthly: £2,877

Annual income: £34,524

No voids. No fees. No stress.

Net gain over traditional: £5,982You earn £6,000 MORE with “lower” guaranteed rent.

To calculate your specific situation, use our guide on how is guaranteed rent calculated and understand how much does guaranteed rent cost.

Which Providers Actually Offer Student HMO Guaranteed Rent?

Not all guaranteed rent providers touch student properties. Here’s who does:

National Providers:

- Northwood: UK’s largest, no hidden fees, proven student track record

- Rentd: Specialists in student/professional HMO hybrid models

- City & Country: Focus on prime university locations

Regional Specialists:

- Manchester: Lavelle Estates, Premier Property

- Leeds: Linley & Simpson, Manning Stainton

- Birmingham: Shipways, Belvoir

- Liverpool: Loc8me, Studentdigz

What They’re Offering:

- 70-85% of achievable market rent

- 3-5 year contracts typical

- Some offer 10-month academic year options

- Maintenance packages usually included to £500/year

For guidance on selecting the right provider, see our article on how to choose a rent guarantee provider.

University City Analysis: Where It Works Best

The Winners: Maximum Yield Cities

Liverpool (11.5% yield)

- Average HMO rent: £95-120/room/week

- Guaranteed rent rate: £76-96/room/week (80%)

- Annual guaranteed income (5-bed): £19,760-24,960

- Supply/demand: Severe undersupply, near 100% occupancy

Manchester (11.5% yield)

- Average HMO rent: £110-140/room/week

- Guaranteed rent rate: £88-112/room/week

- Annual guaranteed income (5-bed): £22,880-29,120

- Key advantage: Multiple universities, year-round demand

Glasgow (10%+ rent growth)

- Average HMO rent: £100-125/room/week

- Crisis level: 3.8:1 student-to-bed ratio

- Guaranteed rent premium: Higher rates due to extreme shortage

- Warning: New Scottish rent controls may impact future rates

The Challenging Markets

London

- Pro: Highest rents (£200-300/week)

- Con: Providers offer lower percentages (65-75%)

- Reality: Still profitable but carefully evaluate offers

For London-specific insights, check our analysis of the best rental yield areas in London.

Oxford/Cambridge

- Challenge: Colleges provide extensive accommodation

- Opportunity: Focus on postgraduate/mature student properties

- Guaranteed rent: Limited providers, selective criteria

The Smart Landlord’s Decision Framework

You Should Choose Guaranteed Rent If:

You’re an “accidental” student landlord

- Inherited a property near university

- Moved away but kept your former home

- Don’t want to learn HMO management

You value predictable income

- Can’t afford 2-3 months without rent

- Need stable income for mortgage applications

- Planning retirement or major life changes

You’re exhausted by student management

- Tired of chasing guarantors

- Fed up with summer void anxiety

- Done with deposit disputes

Your property needs work

- Below EPC C rating (74% considering sale)

- Requires HMO licensing compliance upgrades

- Needs modernization for student expectations

You Should Stay Traditional If:

You have premium properties

- En-suite rooms commanding top rent

- Walking distance to main campus

- Established returning student pipeline

You actively enjoy management

- Good relationships with university accommodation offices

- Established systems for guarantors and deposits

- Time and energy for hands-on involvement

You can absorb risks

- Substantial cash reserves

- Multiple properties spreading risk

- Other income sources

For those considering traditional management, our guide on property management for landlords provides essential insights.

The Implementation Playbook

Week 1: Assessment

- Calculate true net income from current model

- List all time spent on management annually

- Document property condition and compliance status

- Review mortgage terms for company let permission

Use our landlord checklist for renting a house to ensure you haven’t missed anything.

Week 2: Market Research

- Contact 5+ guaranteed rent providers

- Request detailed quotes including all terms

- Verify provider credentials (client money protection essential)

- Check provider reviews from other student landlords

Week 3: Negotiation

- Compare offers (not just headline rates)

- Negotiate terms (everything’s negotiable)

- Clarify maintenance responsibilities (critical for student properties)

- Confirm contract length and exit clauses

Week 4: Transition

- Time the switch (ideal: June/July for September start)

- Notify mortgage lender (get written consent)

- Transfer utility accounts as required

- Complete property inventory (comprehensive photos/video)

Red Flags and Green Flags

Warning Signs to Run From

- Offers above 85% of market rent (unsustainable)

- No experience with student properties

- Vague about summer period handling

- Won’t provide references from current landlords

- Pressure to sign immediately

- No client money protection

Signs of a Quality Provider

- 70-80% of market rent (sustainable model)

- Specific student HMO experience

- Clear maintenance thresholds (e.g., £500/year)

- Established relationships with universities

- Transparent about their sub-letting model

- Strong local presence and team

For more insights on avoiding common pitfalls, read about myths about rent guarantees.

FAQs: Your Burning Questions Answered

Q: How do providers handle the summer void?

A: Quality providers use several strategies:

- Short-term lets to language schools

- Conference accommodation partnerships

- Professional lets to summer interns

- Some simply absorb the cost across their portfolio

Q: What about HMO licensing and compliance?

A: Reputable providers handle:

- HMO license applications and renewals

- Safety certificate coordination

- Council inspections

- Compliance updates

You remain responsible for major structural work and paying for certificates. For comprehensive compliance guidance, see our comprehensive guide to property compliance in the UK.

Q: Can students still be students under guaranteed rent?

A: Yes. The provider becomes your tenant (company let), then sub-lets to students. Students remain students – they just have a different landlord.

Q: What if a provider goes bust mid-academic year?

A: Choose providers with:

- Client money protection (mandatory)

- Ring-fenced rent accounts

- Professional indemnity insurance

- Strong financial track record

Q: Will my mortgage lender accept guaranteed rent?

A: Most do with written consent. Some lenders actually prefer it (lower risk). Always get approval before proceeding. We can provide template letters for lender requests.

For tax implications, consult our guides on tax on rental income and how much tax do you pay on rental income.

The Bottom Line: Adapt Now or Exit Later

The student HMO market faces a fundamental restructuring. The abolition of fixed-term tenancies destroys the traditional academic year model. Rising costs, compliance burdens, and regulatory uncertainty are pushing landlords to the breaking point.

But here’s the opportunity: While others panic-sell into a flooded market, smart landlords are securing guaranteed rent contracts that lock in:

- Predictable income through chaos

- Professional management through complexity

- Compliance handled by experts

- Freedom from the student letting treadmill

As one Birmingham portfolio landlord told us: “I’ve switched three of my five student HMOs to guaranteed rent. The ‘lower’ rent is actually higher than my net income was before, and I sleep at night. The other two? I’m converting them next summer.”

For those considering whether guaranteed rent is worth it, the evidence suggests that in the current market, it often provides better returns than traditional letting.

Your Next Step

The academic year 2026-27 will be the first full year under the new rules. Providers are already adjusting their models and rates. The best deals are available NOW, before full implementation.

For a comprehensive assessment of your options, consider our portfolio review service, which can help you understand the true value of your student properties and the potential benefits of guaranteed rent.

Related Resources

Essential Reading

- Guaranteed Rent vs Traditional Letting

- Understanding How Guaranteed Rent Works

- HMO Licensing Guide

- Renters Rights Act Impact

- UK Landlord Responsibilities

- Property Management of Rental Properties

Tools & Calculators

References

[1] Acorn Finance. (2025, September 21). Navigating the UK Student Accommodation Crisis. Retrieved from https://acorn.finance/2025/09/navigating-the-uk-student-housing-crisis/

[2] Introducer Today. (2025, June 16). HMO sector booming, fuelled by student tenant demand. Retrieved from https://www.introducertoday.co.uk/breaking-news/2025/06/hmo-sector-booming-fuelled-by-student-tenant-demand/

[3] The Negotiator. (2025, May 30). HMO rental yields have reached 12.5%, surprising research reveals. Retrieved from https://thenegotiator.co.uk/news/rental-market/hmo-rental-yields-reaching-12-5-surprising-research-reveals/

Data sources: HESA student statistics 2024-25, Knight Frank Student Property Report 2025, Cushman & Wakefield UK Student Accommodation Report, HEPI/Advance HE Student Academic Experience Survey 2024, local authority HMO registers. Individual results vary by location and property specifics.